Investment Banking Career: Quick Facts

| Median Salary | $243,167 |

| Education/Skills Needed | Bachelor’s Degree MBA and CFA Certification Are Recommended Presentation Skills Confident & Assertive Personality |

| Recommended Securities Exams and Licenses |

Becoming an Investment Banker

If your career goal is to make it big on Wall Street – and you’re willing to take all the risks to get there – consider a career in investment banking. Often viewed as the epitome of Wall Street success for its huge compensation potential and a glam lifestyle, investment banking is well-suited to competitive types who thrive on winning deals. The enviable status of top investment bankers comes at a cost, however. These professionals often work an intense one hundred or more hours per week, especially as they begin their careers.

Investment bankers help their clients raise money to finance initiatives and grow their businesses. Their role entails advising clients like domestic and global corporations, institutions, and governments in underwriting and mergers and acquisition activities. These two paths of investment banking are compared below.

| Underwriting | Mergers and Acquisitions (M&A) |

| Help entities raise capital through securities offerings | Identify potential targets for business acquisition |

| Structure offerings of stocks and bonds, assisting in regulatory and market matters | Present merger or acquisition opportunities to clients |

| Take companies public and raise funds through initial public offerings (IPOs) | Represent either the “buy side” or the “sell side” in negotiation of a potential deal |

Success in investment banking requires a diverse skill set. Technical competence in Excel, financial modeling, and valuation methods are necessities, but are not the only important requirements. Candidates should also demonstrate:

- High GPA from a top university

- The ability to perform in high-pressure conditions

- Relationship management skills for developing and cultivating a client base

- Pitchbook and presentation skills for proposing complex financial transactions

- Sales and negotiation skills to bring deals across the finish line

- High energy, confidence, and assertiveness that inspires and motivates others

Interns and new analysts are often tasked with the routine and repetitive jobs of creating presentations and pitchbooks. These usually go through countless iterations as information changes. Increasing responsibilities and more exciting tasks are earned with time on the job and as new analysts become available to take over the entry-level work.

Where Do Investment Bankers Work?

Wall Street is ranked as the number one location for aspiring investment bankers to make their mark. Each year, thousands of ambitious analysts come to the city to begin internships and training programs with the “Bulge Bracket” banks, which are the most well-known and prosperous investment banks in the business. Los Angeles, San Francisco, Houston, Chicago, Dallas, and Charlotte are also US investment banking hubs on a smaller scale, and are viewed as less demanding when comparing lifestyle and hours worked. London, Tokyo, Hong Kong, Singapore, and Zurich are among the international locations with the greatest draw.

How to Prepare for an Investment Banking Career

The investment banking field isn’t easy to enter. In fact, tens of thousands apply for the ground-level analyst positions each year, and out of every 1,000 applicants, only about 20 (2%) get a job. A significant slice of the applicant pool is from outside of the US and is drawn by the allure of Wall Street experience. Still recognized as the world’s leading financial center, New York offers highly desirable experience for showcasing on resumes and CVs. Investment bankers in New York, and the US overall, are exposed to larger deals and higher volumes of activity than in other financial centers.

1. Earn a bachelor’s degree with honors

A degree in finance, economics, mathematics, accounting, or business is the traditional background for aspiring analysts, but degrees in other fields may be welcome. Firms are recognizing that healthcare, biology, supply chain management, and other non-financial degrees bring diversity to financial teams if candidates have other strong qualities and can learn the required technical skills on the job. A high grade-point – 3.5 or above – and class ranking are expected. An MBA from a strong business school, a law degree, or another graduate degree isn’t a requirement for getting in the door but can certainly help your chances for growth in the career.

2. Find an internship

Use every university resource and your network to find an impressive financial internship. Even if you have a great resume and standout extracurricular leadership experience, because of candidate volume, you’ll need actual work experience to help push your resume through. You should start looking no later than the second year of your undergraduate program if you’re serious about your internship. A large percentage of new investment banking hires have had internships with their firm, so this is a critical step if you’re serious about becoming an investment banker.

3. Get securities licensed

The firm that hires you will require you to get securities licenses. Generally, you’ll need a Series 7, Series 79, and Series 63, which you can only acquire after you are employed and sponsored by a financial firm. However, you can improve your resume by passing the Securities Industry Essentials Exam (SIE) before you are hired.

4. Commit to professional development and certification

Continuing education course completions will be required for keeping your licenses up to date. Advanced certifications are also highly recommended for career advancement. The Chartered Financial Analyst (CFA) certification from the CFA Institute is one of many financial certifications that may be useful. CFA certification is a rigorous program and the designation is earned after candidates pass three levels of exams. CFA candidates must hold a bachelor’s degree and four years of qualified work experience.

How Are Investment Bankers Paid?

Investment banker compensation ranges vary by position, education, certification, background skills, and years in the career. Analysts and associates (the next step on the career ladder) usually earn a bonus business profitability that is frequently in the range of 20% or more of salary. With advancement in the career, the percentage of performance-based compensation increases, so senior-level employees often earn bonuses that are many multiples of their base salary.

The table below includes salary and bonus and shows the high compensation potential for those who advance in the career.

| Position | Experience | Compensation Range |

| Analyst | First year | $70,000–$150,000 |

| Analyst | Third year | $120,000–$350,000 |

| Associate | First year | $150,000–$350,000 |

| Associate | Third year | $250,000–$350,000 |

| Vice President | $350,000–$1,500,000 | |

| Managing Director/Partner | $500,000–$20,000,000+ |

Stand Out as a Candidate for an Analyst Position

Put the SIE Exam on your list of accomplishments if you’re eager to break into this field. Passing this exam will help you learn the foundation and language of the industry and demonstrate your initiative to potential employers. Knopman Marks will guide you with best practices to help ensure a passing score. We look forward to helping you prepare for a rewarding career in finance.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

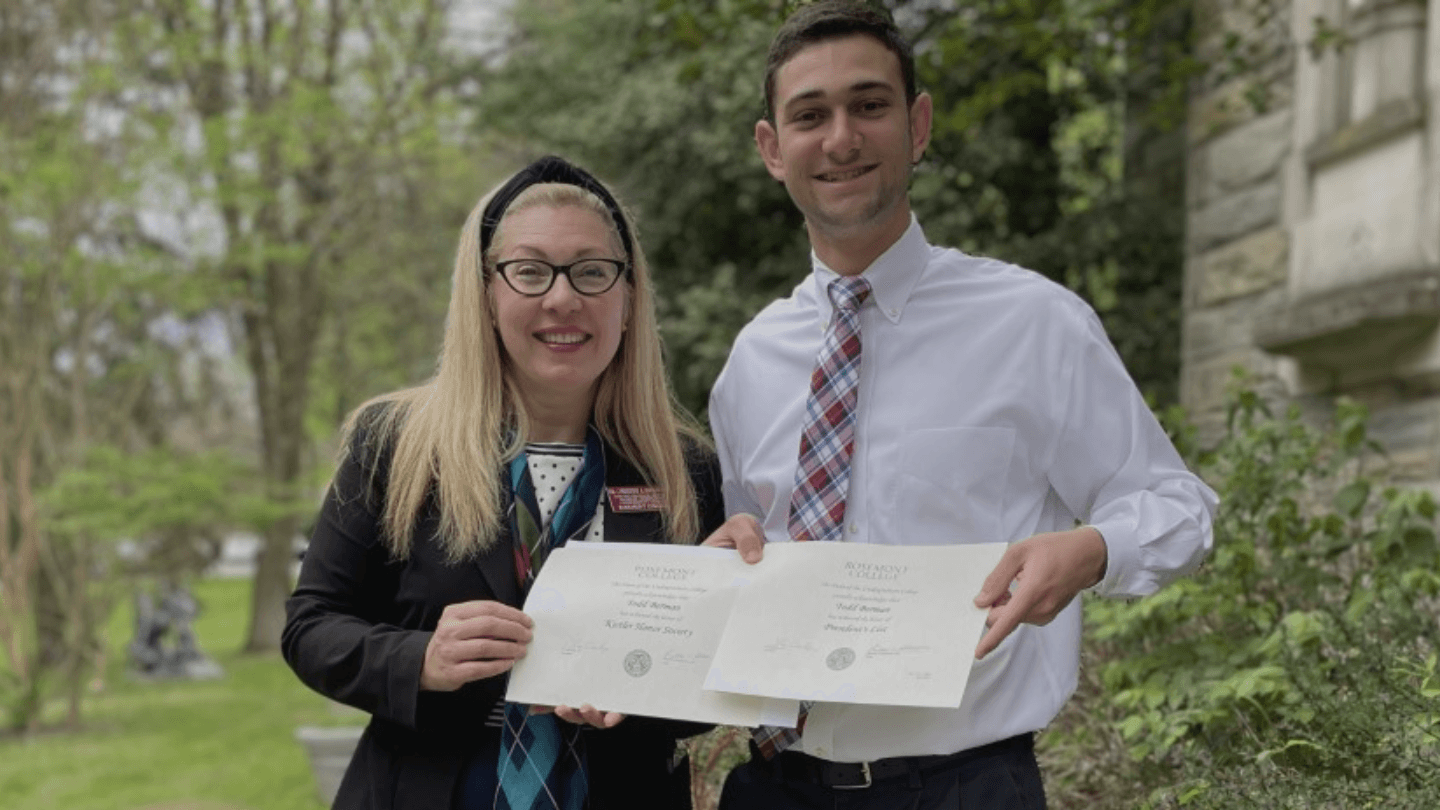

SIE Scholarship Helps College Students Pursue Dream Careers in Finance

After Rosemont College senior Brandon Lam finished taking his SIE exam, he ran outside to the big

- Read more

Introducing How to Finance: A Beginner’s Guide to the Industry

One of our primary roles as educators is to bridge gaps in knowledge. Our newest course, How to F