The SEC’s New Marketing Rule for Investment Advisers modernizes requirements for adviser advertising and solicitation. These changes are the first modifications to investment adviser advertising rules since 1961 and were long overdue to address rapidly evolving business practices and technology. Nearly all U.S. investment advisers are impacted by the new rule, which went into effect May 4, 2021. The compliance date is November 4, 2022, giving investment advisers an 18-month transition period to implement advertising, and related record keeping and Form ADV filing changes.

Read on for a summary of the provisions in the lengthy and complex new rule that are most significant for securities qualifications exam candidates. Individuals preparing for Series 63 Series 65 and Series 66 and other securities exams are likely to see questions that reflect this material.

How Does the New Marketing Rule Define Advertising?

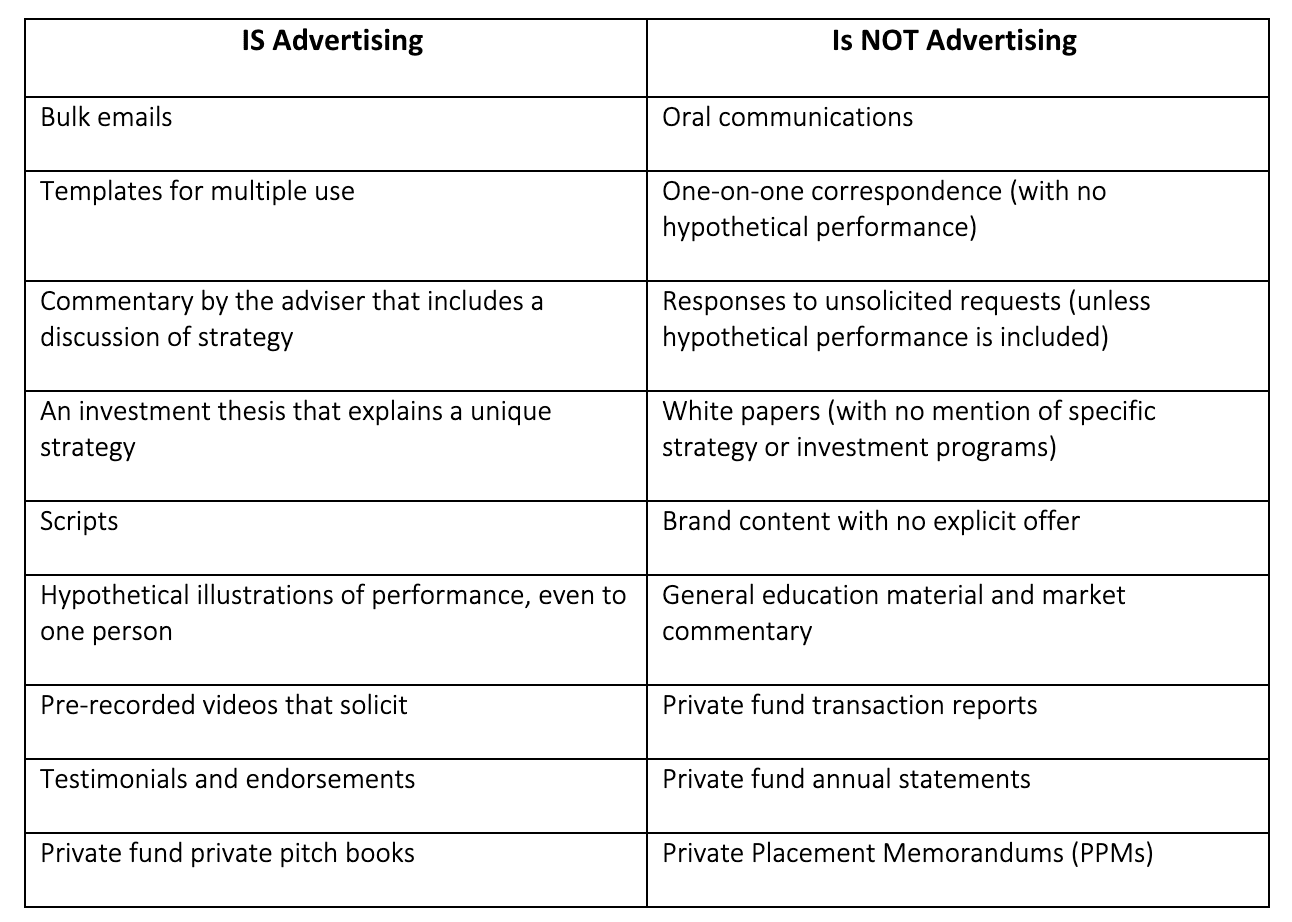

Under the rule, an advertisement includes any direct or indirect communication made by an investment adviser to more than one person that offers new or additional services regarding securities. In this context, persons can be clients or prospective clients of the adviser, or investors in private funds like hedge funds or private equity funds that are advised by the investment adviser.

The rule’s definition of advertising explicitly excludes one-to-one communications, except when the communication includes hypothetical performance. All projections of performance, even if made to one person, are classified as advertising under this rule.

Indirect and non-written communications, like pre-recorded videos and commentary that is endorsed or promoted by an adviser through social media, are examples of communications that often fit within the definition of advertising. But for many types of social media communications, the lines are blurry. The concepts of adoption and entanglement are provided as guidance.

- Adoption occurs if the adviser explicitly or implicitly endorses or approves information after it is published.

- Entanglement occurs if the adviser is involved in the preparation of the communication.

The more an adviser becomes involved in a communication, the more likely it must be viewed as that adviser’s advertisement.

Are Testimonials and Endorsements Considered Advertising?

New additions to the classification of advertising are compensated testimonials and and endorsements, which previously were not permitted for investment advisers.

- A testimonial is defined as a statement made by a client or an investor in a private fund about their experience with the adviser or its supervised persons.

- An endorsement involves a non-investor or non-client relating their experience.

A simple test to determine whether a communication is advertising is to ask whether it truly offers new or expanded services or is a client services response. Communications that are service-related only are not advertising.

What Practices Are Prohibited or Restricted Under the New Rule?

The new marketing rule includes many familiar anti-fraud prohibitions. Generally, advertisements cannot:

- include untrue material statements and omissions

- include unsubstantiated material statements of fact

- include untrue or misleading implications or inferences

- discuss potential benefits from the adviser’s services or methods without a fair and balanced treatment of material risks or limitations

- include a reference to specific investment advice by the adviser unless it is presented in a fair and balanced manner.

What Special Restrictions Apply Under the New Marketing Rule?

Special restrictions apply to certain areas of regulatory concern, such as performance advertising, use of hypotheticals, testimonials, and third-party ratings. These raise regulatory red flags because inaccuracies and unsubstantiated statements could be damaging and misleading to investors.

- Performance Advertising. The new rule requires presentation of gross and net performance with at least equal prominence, calculated over the same time period, and using the same type of return and methodology. Time periods are prescribed (usually 1, 5 and 10 years). The adviser cannot imply review or approval by the SEC of any calculation or presentation of performance results.

- Hypothetical Performance. Hypothetical performance encompasses illustrations of models, and targeted, projected or back-tested performance results. Advisers must ensure that any illustrations of hypothetical performance are relevant to the situations and investment objectives of the intended audience.

- Testimonials and Endorsements. Advertisements that include these must clearly and prominently disclose whether the person giving the testimonial or endorsement is or is not a client, whether the individual is compensated, and any material conflicts of interest arising out of the relationship with the adviser. Disclosures must be included within the advertisement and must be at least as prominent as the testimonial or endorsement. Advisers must enter into written agreements with third parties who will be compensated for testimonials and endorsements. A de minimis exception applies when direct or indirect compensation is 1,000 dollars or less, in which case no written agreement is required. Bad actors disqualified or convicted under securities laws cannot be paid for testimonials or endorsements.

- Solicitations by Promoters. The new rule generally uses the term promoter in place of “solicitor.” Because the Marketing Rule now applies to the solicitation of private fund investors, placement agents, consultants, capital introduction groups, and other parties involved in marketing, private funds may be viewed as promoters and will be subject to the same disclosure and written agreement rules that apply to testimonials and endorsements.

- Third-Party Ratings and Surveys. Ratings or surveys prepared by entities that provide these services can be used in advertising if the ad includes the date or time period of the rating or survey, name of the rating provider, and whether compensation was paid. Rating or survey information can only be used if there is reasonable basis to assume the results were obtained fairly.

What Are the New Adviser Record Keeping and Form ADV Requirements?

Advisers must make and keep records of all advertisements. Under the prior rule, advisers were only required to make and keep records sent to ten or more people. ). In compliance with SEC requirements, these records must be kept for a minimum of five years. The amended rule also requires advisers to keep copies of documentation supporting the calculation of performance; documentation substantiating the adviser’s reasonable basis for believing that a testimonial, endorsement, or third-party rating complies with the requirements of the Marketing Rule; and a record of the disclosures delivered to investors in connection with testimonials, endorsements, and third-party ratings.

Form ADV has been amended to include a new subsection for information about adviser marketing practices. Advisers will also be required to provide information about their use of performance results, testimonials, endorsements, third-party ratings, and references to specific investment advice in advertisements on their Form ADV.

Learn more about Knopman Marks

If you would like more information about Knopman Marks’ industry leading exam prep services, visit us or contact us.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

SEC Shortens Settlement Cycle for Most Securities to T+1: Updates for Exams Going Forward

The SEC has officially updated the rules to shorten the standard settlement cycle for most securi

- Read more

What You Need to Know: New Crowdfunding and Exemption Regulations

Effective March 15, a new SEC regulation will change certain registration exemptions to increase

- Read more

Overview: New SEC Regulation Best Interest (Reg BI)

New SEC Regulation Best Interest (Reg BI) raises the bar for broker-dealer conduct when making re