Risk Manager Career: Quick Facts

| Median Salary | $97,636 plus bonuses |

| Education/Skills Needed | Bachelor’s Degree in Business, Accounting, or Mathematics MBA Is Strongly Recommended Strong Analytic & Communications Skills 5 Years of Related Work Experience |

| Recommended Securities Exams and Licenses |

Becoming a Risk Manager

Have you ever considered these questions?

- How does a major financial institution prepare for the worst market crash in history?

- How does an auto insurance company decide what drivers to insure?

- How many bank credit clients are likely to default on their loans?

- How many coastal properties will be demolished by hurricanes in a given year?

If such business problems intrigue you, and you’re skillful in statistical analysis and strategic planning, risk management may be a field to consider. Risk managers project and de-construct provocative situations as they look for ways to “de-risk” the businesses they work in.

Sometimes known as risk analysts, risk technicians, or risk management specialists, risk managers analyze and address the potential risks that threaten a business’s assets, earning capacity, or success. They monitor market changes and trends, then create models and simulations to forecast outcomes so that they can prepare for the risks they’ve identified. They project worst-case scenarios so that their business can not only function but ultimately succeed through adverse conditions.

Where Do Risk Managers Work?

In financial services, risk managers work in home offices of investment and commercial banks, mutual funds, other investment companies, and life, health, and property insurance companies. Although risk managers are vital to nearly any line of business, financial service risk managers apply their skills to underwriting, trading, sales, private banking, credit, and insurance.

Risk managers go by many names in the financial industry, with each role focusing on a specific area:

- Market specialists analyze outcomes of financial transactions such as mergers or IPOs.

- Trading risk technicians evaluate the potential for and impacts of stock market events like severe downturns, system-wide failures, or disasters.

- Operational specialists assess the probability of cyber-attacks, identity theft, or other such system events.

- Regulatory and compliance specialists monitor legislation and project the operational impacts of newly adopted legislation.

- Investment risk specialists evaluate the mix of securities in a portfolio and the impacts of market events such as interest rate changes, especially with complex instruments like mortgage-backed securities, margin loans, and valuations for stock and options.

- Insurance risk managers project the likelihood of fires, hurricanes and natural disasters, or personal crises like health events or auto accidents.

- Credit analysts determine the likelihood of repayment of consumer loans.

In any of these roles, the objective is to test the business’s readiness for risk events and ensure it has safeguards and procedures to mitigate the impact if and when these events occur.

How to Prepare for a Risk Management Career

Risk management is typically not an entry-level career opportunity, as most companies do not hire and train risk managers just out of college. Instead, preference is given to candidates that have at least five years of experience working in related business or finance fields. Many start out as accountants, auditors, financial analysts, or loan officers with mathematics, economics, or other business degrees.

Key skills for risk managers are:

- Strong analytical skills and detail orientation

- Project management skills

- Excellent organizational and communication skills

- Expertise in resource planning software and spreadsheets

- Knowledge of financial hedging tools like options, derivatives, and insurance

An internship is one of the best ways to break into the field and can reduce the work-experience requirement for some candidates. Coursework in investments, statistics, project management, insurance, audit, and risk management strengthen the resume. Securing an internship should be a priority starting in the second year of college.

A graduate degree from a top university in business administration or a similar major, like finance or economics, is also an edge. Some graduate programs offer a risk management focus with specialization in fields like investment management, healthcare finance, insurance enterprise risk management, and corporate finance.

Certifications for Risk Managers

A number of certifications are available for professional development and career advancement:

- Financial Risk Manager (FRM) certification is available through the Global Association of Risk Professionals and is one of the most recognized credentials in the field. Two examinations must be passed that cover topics like risk analysis tools, quantitative analysis, financial markets, valuation models, and risk management application strategies.

- Certified Financial Analyst (CFA) certification is offered by the CFA Institute. Attaining this certification requires successful completion of three levels of rigorous exams. The certification covers topics beyond those necessary for risk management expertise, but it’s well recognized and respected in the industry. It usually requires 18 months to four years for completion.

- Certified Risk Manager (CRM) certification is administered by the National Alliance for Insurance Education and Research, and benefits risk management professionals in the insurance industry. It includes five courses and exams covering principles of risk management, analysis of risk, financing of risk, control of risk, and practice of risk management. All must be completed within a five-year period.

- Associate in Risk Management (ARM) is a credential offered by the American Institute for Chartered Property Casualty Underwriters. ARM certification requires candidates to complete three courses and to pass an examination.

- Certified Professional in Healthcare Risk Management (CPHRM) is coursework and an exam administered by the American Hospital Association Certification Center.

How Are Risk Managers Paid?

A risk manager’s compensation is often a combination of base salary and bonus, with heavy dependence on performance in the prior year. Analysts who minimized losses may see a large spike in pay, while the reverse is also true if yearly performance did not live up to expectations. Bonuses in the forms of cash, stock, or options are common. In positions where portfolios are managed, profit-sharing or fees based on performance are typical. These bonuses and benefits can be large and increase compensation significantly above the standard base salary.

According to salary surveys, base pay ranges from $50,000 to $180,000 depending on performance and experience. Large banks and insurance companies offer the highest base pay and bonus potential.

Improve Your Chances in Financial Risk Management

Preparing for a risk management career requires the right background. Passing the SIE Exam can distinguish you as a candidate for an internship or first job. This exam demonstrates that you know foundational concepts and the language of the financial industry, and it shows your initiative to potential employers. Knopman Marks will give you the best preparatory guidance in the industry and assist you every step of the way as you prepare to pass the SIE Exam. To learn more about the SIE Exam and to download a practice exam, click here. We look forward to helping you as you pursue a rewarding career in risk management.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

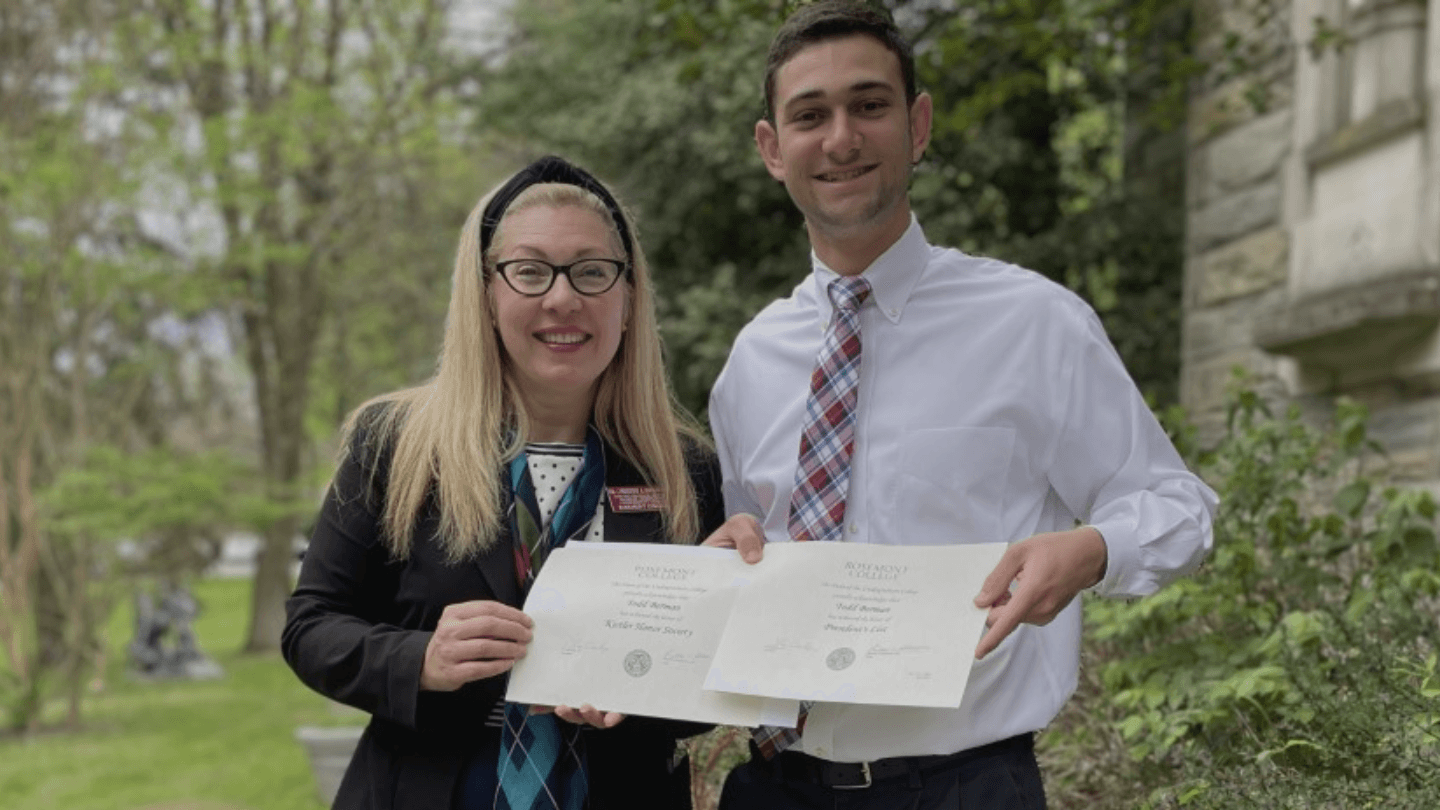

SIE Scholarship Helps College Students Pursue Dream Careers in Finance

After Rosemont College senior Brandon Lam finished taking his SIE exam, he ran outside to the big

- Read more

Introducing How to Finance: A Beginner’s Guide to the Industry

One of our primary roles as educators is to bridge gaps in knowledge. Our newest course, How to F