Town Hall Takeaways: Make Way for the Securities Industry Essentials (SIE) Examination

Filed in: FINRA News, Knopman News, Series 7, Series 79, SIE Exam, Working in Finance

FINRA’s restructured qualification exam program is a game changer for the securities industry and its protocol for bringing new registered reps into the business. The re-designed exam program, which includes the Securities Industry Essential exam (SIE), launches October 1, following more than 40 years of business as usual in the new rep registration process.

The SIE credential will be an important first step to entering the securities industry, especially for individuals with no prior securities industry experience – an investor, a recent college graduate, or a professional seeking a second career.FINRA, March 2017 Press Release

Knopman Marks’ recent Securities Industry Town Hall Event united professionals from nearly 50 top Wall Street firms, staff from university career development centers, content experts from online financial knowledge leader Investopedia, and FINRA qualifications managers in an insight filled forum. The forum presented a review of the new SIE program from FINRA, practical insights into exam program implementation from exam experts Knopman Marks, and a much-anticipated open-mic opportunity for audience questions. Download the full SIE Exam presentation here.

Panelists Included:

- Joe McDonald – FINRA (Senior Director, Qualifications and Exams)

- Brian Marks – Knopman Marks (Partner)

- Dave Meshkov – Knopman Marks (Managing Director, Head of Course Design)

Moderator: Liza Streiff – Knopman Marks (Partner)

At this point, many firm registration departments have preliminary steps in motion for October 1 readiness. But, meeting presentations and participant questions highlighted the need for continued focus to ensure a smooth implementation.

5 Essential Reminders

The upcoming changes impact many business practices and personnel, and now is a good time to assess your readiness as discussed below.

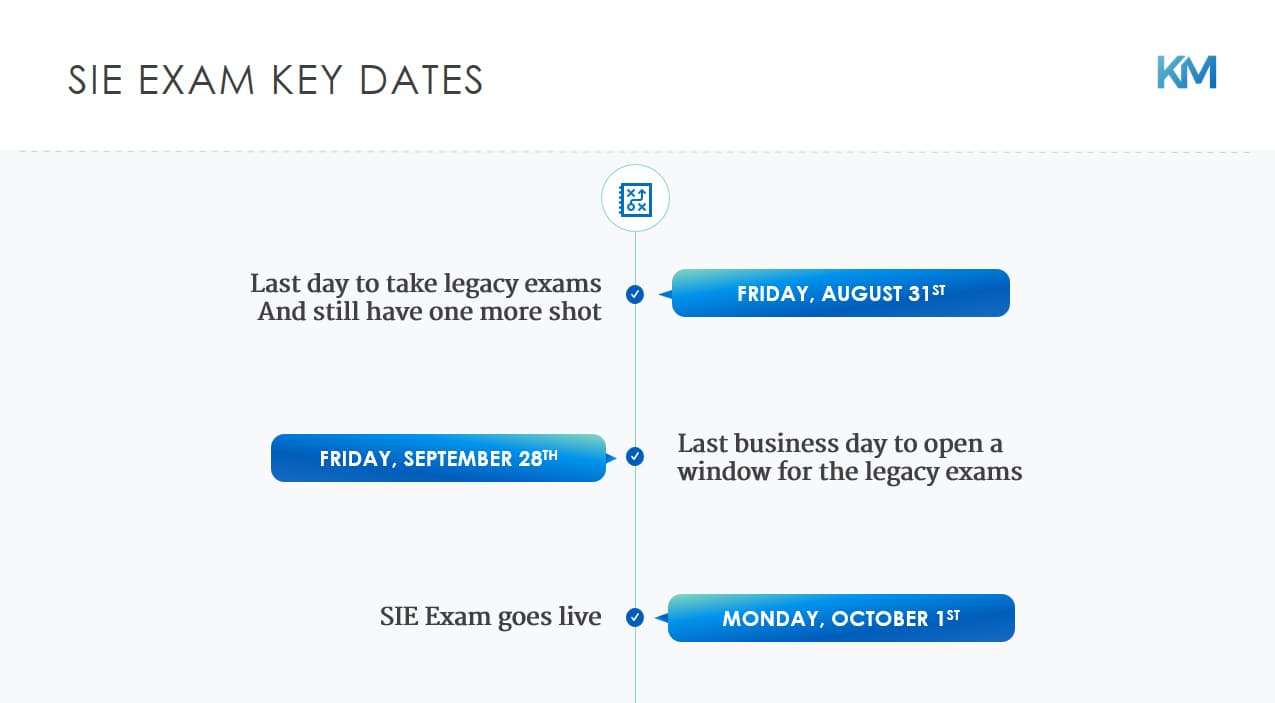

- New exams are hard to predict so a push for the current exam may be smart. It seems apparent from the SIE outline and FINRA guidance that the SIE exam is not going to be an “easy” exam. Rules and regulations of the industry are likely to be covered at a Series 7 level of detail, and although product concepts will be more introductory, there is still a broad base of information that must be mastered. Creating a sense of urgency to take current exams before it’s too late could make a lot of sense. Key dates to incorporate into the communication strategy include:

Also, with Prometric as the sole exam provider, it may not be easy to get appointments at busy exam centers, so the sooner, the better. - Many are impacted, but few are educated. Obviously, licensing, registration and compliance departments are digging deep into the new rules to make appropriate changes to on-boarding processes and plans. But, there are many functional areas that need awareness. It may be time to plan an educational strategy to ensure these parties are in the know. Stakeholders from HR, learning and development, IT, recruiting, and other business areas should understand how the “no sponsor needed” provision of the SIE could change the approach to business as usual. And, because the exam can be taken by anyone, other business areas may want to encourage SIE training and testing for professional development. The foundational learning incorporated into the SIE exam can be a great base for employees in any supportive role.

- SIE exam tracking is available if you pay to play. For some firms, qualification exam scores and number of attempts to pass have been an important metric. With SIE’s implementation, much less information about exam activity will be public – including scores and number of attempts. Candidates that are not sponsored and pay their own testing fees will not be included in the CRD. Firms will only have access to SIE information about these candidates when they are in the hiring process and conduct a background check, or file a U-4 for the candidate. At that time, if the candidate has passed the SIE exam, only the passing status is reported, with no score or number of attempts. If the exam has been attempted but not passed, the attempt(s) are recorded.FINRA’s new voucher program offers firms more control in the process. Firms can provide vouchers to candidates which pay for their SIE exam fee of $60 any time in the following 6 months. The voucher number will allow the firm to track whether the exam was passed or failed. If this information is important to your firm, it may be time to plan a voucher strategy. FINRA will be updating their exam restructuring page with details about the voucher program soon. Vouchers can first be purchased from FINRA on October 1, 2018.

- You’ll be running 2 FINRA rep level exam programs simultaneously for 4 months. Because of the 120-day exam window, there will be a 4-month period of overlap in exam administration. Candidates with testing windows that open on September 30 – the last possible day for the old exam—will have until the end of January for their first attempt on the old exam. But remember, if they fail on the first attempt, they then take the SIE and the new Series 7 top-off. No 30-day waiting period applies in this scenario because it’s a different exam.Another reminder: no SIE change applies for NASAA exams. The Series 63, 65 and 66 are unaffected by the SIE. Principal level exams are also untouched for the time being, although change is slated for these exams as well. FINRA has stated their intention to focus on a principal exam initiative following SIE’s successful implementation.

- 2019 Summer Programs may need scheduling flexibility. Most firms expect to refine their expectations of whether the SIE credential will be required for hire over the next several years. Meanwhile, starting 2019, it’s possible that some candidates will have passed the SIE and will need training only for their top-off exams, while others new to the program will need to pass both tests. This presents some new planning challenges beginning with 2019 programs.To mitigate disruption, firms should consider holding the SIE training portion of their program at the very beginning of summer training, with top-off training later in place of where the Series exam training was normally held. Candidates who have the SIE could join the program after SIE training is complete for the other candidates

Top-off Exam Details

The specifics of the top-off exams are noted in revised outlines for each exam. In all cases the number of questions and time allotted for exam completion has been reduced because of the elimination of redundancy.

After retiring unnecessary exams, eight top-offs remain and go into effect October 1, including the MSRB’s Series 52, for which no details have yet been released.

The table below provides a summary of top-off exam details.

| Top Off Series | Number of Questions | Time for Completion |

| Series 6 | 50 | 90 minutes |

| Series 7 | 75 | 225 minutes |

| Series 22 | 50 | 90 minutes |

| Series 52 | TBD | TBD |

| Series 57 | 50 | 105 minutes |

| Series 79 | 75 | 150 minutes |

| Series 82 | 50 | 90 minutes |

| Series 99 | 50 | 90 minutes |

For a refresher of other SIE and top-off exam basics, review our recent article: SIE FAQs – Recent Updates from FINRA.

Town Hall Q&A Recap

The Town Hall audience participation segment generated excellent dialog as reflected in the great questions from the audience. The Q&A summary below includes expert insight into some top of mind issues.

Exam Information

Q: A candidate takes a current exam in September and fails, so will need to take the SIE and a new top-off exam to complete the process. Will the material studied previously be enough to pass or will the candidate need to study new material?

A: The answer depends on the exam attempted. For Series 7, it is anticipated that most information will carry forward, but for Series 79, the SIE will include more breadth on currently untested topics including retirement plans and municipal bonds.

Q: Are SIE candidates who fail the exam subject to a waiting period before retesting?

A: The current 30/30/180 rule applies to the SIE. For the first two exam failures, there is a 30-day waiting period. A 180-day waiting period applies after the 3rd failure.

Q: Does the 120-day testing window apply to the new SIE and top-offs?

A: Yes, this standard has been in place for many years and will continue. If windows are requested for a candidate for both exams at the same time, the 120-day windows would run concurrently, not consecutively.

Q: Are candidates required to take the SIE exam before a top-off?

A: Because the SIE and a top-off are “co-requisites” for registration, there is no requirement to take the SIE first. Candidates could also take both exams on the same day. If a top-off was passed and the SIE was failed, the top-off would still count, but the candidate would not be registered until the SIE was passed. Knopman Marks recommends that for best results, the SIE should be the first exam taken, followed by the appropriate top-off, and that studying should be sequential for the best chance of success.

Q: The SIE content outline is very detailed and long. How does this balance with the idea that the test will cover concepts at a “basic” or “fundamental” level?

A: The questions will not be simple. Candidates will be expected to demonstrate knowledge of fundamental concepts, and some product feature questions will be straightforward and basic. For example, on the SIE only basic options strategies will be included; the Series 7 top-off will address advanced strategies like spreads and straddles. In other topics that are fully removed from the top-offs because they apply to all registrants, more in-depth knowledge is expected. FINRA rules, such as outside business activities, gift rules, AML are examples of these topics, and it is anticipated that will be tested at a level similar to the current Series 7.

Training and Materials

Q: How long will it take to train for the SIE Exam?

A: It’s uncertain at this time, but candidates with relatively strong backgrounds and experience are expected to need a minimum of 1 ½ days of training. The level of specificity and the complexity of the questions is unknown. At Knopman Marks, our intention at the outset will be to deliver a highly comprehensive and longer class, and then tailor it appropriately as we have more experience with the new test.

Q: When will SIE study materials be available, and what will they cost?

A: Knopman Marks study materials for the SIE will be available this summer. Although final pricing is not yet available, the cost for the SIE materials plus top-off exam materials together is expected to equal current pricing. For example, the cost of the SIE and Series 7 top-off will be approximately equal to today’s Series 7 price.

Exam Administration

Q: What information will be captured when a non-sponsored individual applies to take the SIE exam? Will this information have to be re-entered when the individual continues the registration process when sponsored by a firm to take the top-off?

A: FINRA is continuing to define these data points and their new system for SIE non-sponsored candidate registration. Generally, the information collected for the SIE will be name and address, Social Security number and other basic identification information. This information will not automatically populate a U-4, so when the person associates with a member firm, re-entry will be required.

Q: Will Prometric, the testing vendor, be able to absorb the increased volume of exams resulting from the SIE/top-off exam restructuring?

A: Although it’s expected that more exams will be taken, the total number of questions and time allotted for completion of all exams has been significantly reduced. FINRA is confident that initial demand can be handled, but will carefully monitor the situation and address as needed.

General Information

Q: Have colleges and universities indicated any plans to participate in SIE preparation?

A: At this stage, there seems to be no strong direction because the concept is too new. However, they have indicated that they will respond based on what the large banking programs that hire their graduates want them to do. Certain schools have shown some interest in hosting onsite training for the SIE exam, but are not yet incorporating it into their curriculums. We have also seen interest from finance clubs and investment banking clubs who may wish to sponsor SIE training to build resumes of their members. As the concept matures, it’s expected that conversations will ramp up and the roles of colleges and universities will evolve.

Q: Are rules for permissive registration changing on October 1? How will firms track permissive registrants?

A: The new registration rules will permit firms to permissively register any person in any registration category, provided they are supervised appropriately for the functions they perform, as discussed in FINRA Regulatory Notice 17-30. How this will be indicated in CRD is not yet finalized, but initially it will most likely up to the firms to track this.

Stay Informed with Knopman Marks

We know how “essential” it is for you to stay current on the emerging details of FINRA’s exam restructuring, so we invite you to subscribe to our newsletter below. With your feedback and ideas, we are working towards a seamless transition to the new world of SIE and top-off exams coming very soon. We look forward to partnering with you for a successful launch!

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

How To Pass the Series 7 Exam in 2025

You’ve already passed your SIE and you’re ready for the next step – the Series 7 exam. The Series