FINRA Guidance and Requests for Comments on the SIE

Filed in: Exam Content, Knopman News, Series 7, Series 79, SIE Exam

FINRA has published a regulatory notice (15-20) with further guidance on the Securities Industry Essentials Examination (SIE) and its content.

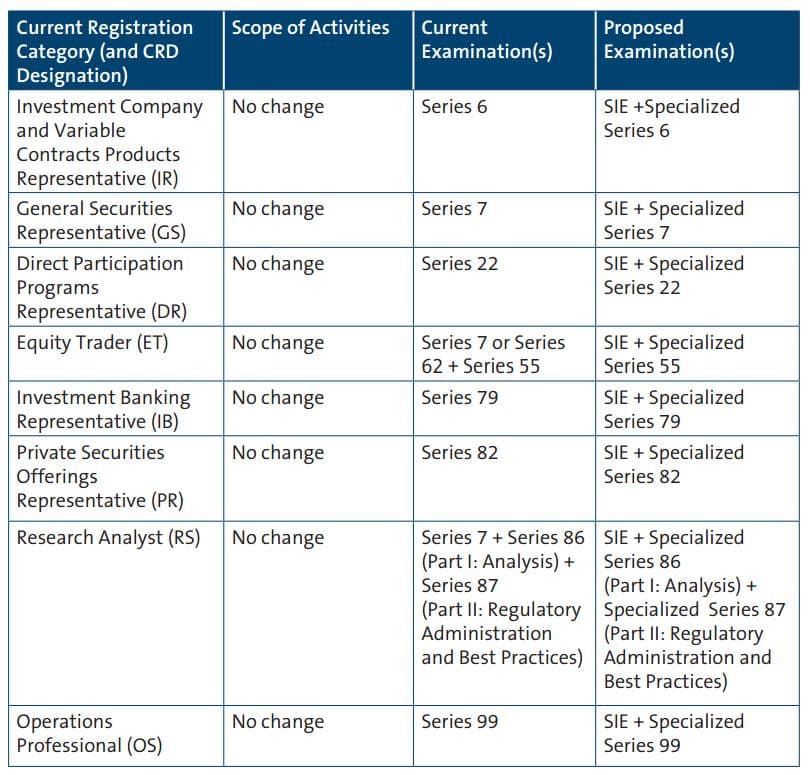

As discussed in our earlier post on the SIE, the SIE will be available to everyone (candidates do not need to be associated with a FINRA member firm) and a passing result on the SIE would be valid for four years. Once associated with a member firm, employees will need to pass a specialized knowledge examination that will test content specific to that registration category or job function. For example, to function as a General Securities Representative an individual must pass the SIE + Specialized Series 7.

FINRA also indicated that it will consolidate the number of exams and retire certain registration categories (e.g. Series 42, 62, & 72) in the transition to the SIE + Specialized Knowledge Exam. Individuals registered in any retired categories will maintain their registration and ability to function in that capacity.

FINRA’s Proposed Testable Content on the SIE

FINRA has indicated that SIE will have 75-100 questions assessing knowledge deemed fundamental to working in the securities industry, such as basic product knowledge; structure and functioning of the securities industry markets, regulatory agencies and their functions; and regulated and prohibited practices. The SIE will cover a broad range of industry content that reflects the diversity of regulatory agencies, securities products, and regulated practices.

The draft outline contains four proposed major topic areas:

- Knowledge of Capital Markets: Focuses on topics such as types of markets and offerings, broker-dealers and depositories, and economic cycles.

- Understanding Products and Their Risks: Covers securities products at a high level as well as associated investment risks.

- Understanding Trading, Customer Accounts and Prohibited Activities: Types of accounts, orders, settlement and prohibited activities.

- Overview of the Regulatory Framework: Topics such as SROs, registration requirements and specified conduct rules.

What Registration Categories will have Proposed Specialized Knowledge Examinations?

FINRA has indicated it will develop specialized exams for the following representative categories to be roll-out in two phases. The first set of specialized exams will include the SIE and three specialized exams to be introduced in the fourth quarter of 2016, with the remaining specialized exams introduced in the first half of 2017.

- Investment Company and Variable Contracts Products Representative (4th quarter 2016)

- General Securities Representative (4th quarter 2016)

- Investment Banking Representative (4th quarter 2016)

- Direct Participation Programs Representative (1st or 2nd quarter of 2017)

- Equity Trader (1st or 2nd quarter of 2017)

- Private Securities Offerings Representative (1st or 2nd quarter of 2017)

- Research Analyst (1st or 2nd quarter of 2017)

- Operations Professional (1st or 2nd quarter of 2017)

The following table illustrates the proposed changes to the representative-level examinations for those representative categories that FINRA is proposing to retain.

Other Relevant Information from the Notice

Principal-Level Exams: The SIE will not impact principal-level registration categories (e.g. Series 24).

Examination Fees: The fee for the SIE has not yet been determined, but FINRA’s indicated it will allow individuals to sign-up and pay the examination fees on their own (whether associated or not) and also allow firms to pay the examination fee for their associated employees should the firm choose to do so.

Continuing Education: The proposed examination structure does not affect the current continuing education requirements. Individuals who have passed the SIE but not a specialized knowledge examination and do not hold a registered position would not be subject to the continuing education requirements.

Conclusion

We will continue to track and stay abreast of industry comments and any further information and guidance from FINRA as this process unfolds. We will share our insight and knowledge here at the Knopman Marks blog. Please feel free to reach out to us or to your Knopman Marks contact if you have any questions or wish to further discuss the SIE.

Written by Dave Meshkov

Dave's mission (and job: Managing Director of Course Design) is to make FINRA exam training engaging, approachable, and dare he even say, enjoyable. Having trained and coached over ten thousand students to exam success he knows how to present complex subjects in memorable and understandable ways. Prior to joining Knopman Marks in 2011, Dave practiced bankruptcy law at Weil, Gotshal & Manages and served as a law clerk in a the Southern District of New York Bankruptcy Court working on the General Motors and Lehman Brothers bankruptcies. Building on his legal expertise and training allows him to keep all our courses updated with the latest legislative and rule-making changes. Dave currently trains for the Securities Industry Essentials (SIE) exam and the Top-Off Series 6, 7, 24, 57, 63, 65, 66, 79, 86, 87, and 99 exams. He also delivers executive one-on-one training and shares his passion for learning outside of work as a ski instructor and yoga teacher. Dave graduated magna cum laude from Fordham Law School, and cum laude with a BA from the University of Pennsylvania.

Related posts

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont

- Read more

Master the Series 63 Exam with the Video Vault

Are you feeling overwhelmed by the dense text of Series 63 exam prep? Do you consider yourself mo

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an