Bond Yields

Bond yields refer to the different ways of expressing the value of a single bond. For any bond, the following yields can be calculated:

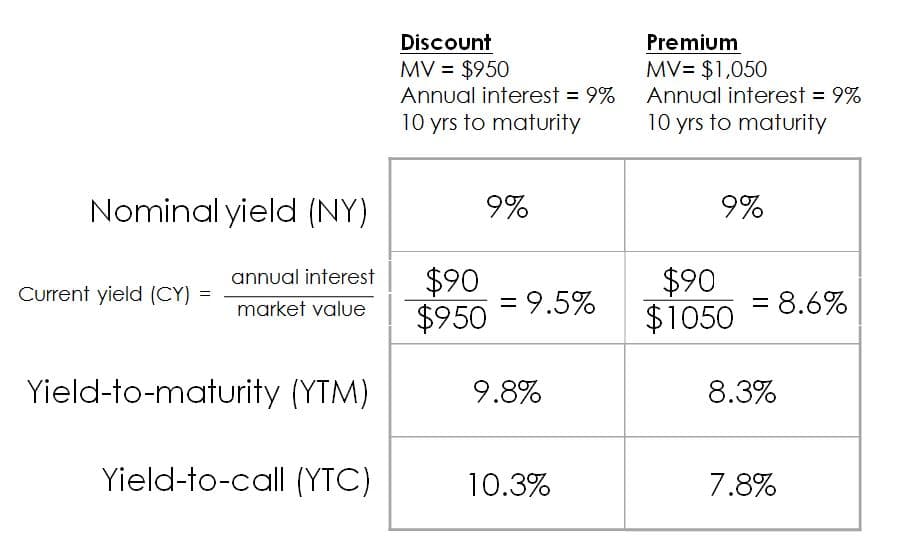

- Nominal Yield (NY): Calculated based on the actual dollar amount of interest paid on the bond annually. For example, a $1,000 par value bond paying $90 of annual interest would have a nominal yield of 9%.

- Current Yield (CY): Calculated based on the current market value of the bond. For example, a 9% bond currently trading at 95 has a current yield of 9.47%, calculated as 9 / 95.

- Yield-to-maturity (YTM): YTM is the same as the internal rate of return. It reflects not only the coupon on the bond but also the difference between the purchase price and par value. For example, a 10-year 9% bond purchased at 95 would receive $90 of interest along with a $50 capital gain at maturity. The YTM of this bond would be 9.81%. The YTM cannot be calculated with a basic calculator, it can only be calculated with a spreadsheet or financial calculator.

- Yield-to-maturity (YTC): YTC reflects the overall return on the bond if it is called away prior to maturity. For example, if a 10-year 9% bond were purchased at 95 and called away at par after 5 years, the YTC would be 10.33%. The YTC, like the YTM, must be calculated with a spreadsheet or financial calculator.

The four yields described here will always go either in ascending or descending order depending on if the bond is purchased at a discount (i.e. below par) or at a premium (i.e. above par). For a discount bond, the order will always be YTC > YTM > CY > NY. For a bond purchased at a premium, the order will always be NY > CY > YTM > YTC. Knowing these relationships is very important for FINRA qualification examinations.

Knopman Notes

Candidates should be familiar with the order of bond yields for a discount or premium bond.

Discount bond: YTC > YTM > CY > NY

Premium bond: NY > CY > YTM > YTC

Relevant Exams

Series 7, Series 65, Series 66, Series 79

Written by Dave Meshkov

Dave's mission (and job: Managing Director of Course Design) is to make FINRA exam training engaging, approachable, and dare he even say, enjoyable. Having trained and coached over ten thousand students to exam success he knows how to present complex subjects in memorable and understandable ways. Prior to joining Knopman Marks in 2011, Dave practiced bankruptcy law at Weil, Gotshal & Manages and served as a law clerk in a the Southern District of New York Bankruptcy Court working on the General Motors and Lehman Brothers bankruptcies. Building on his legal expertise and training allows him to keep all our courses updated with the latest legislative and rule-making changes. Dave currently trains for the Securities Industry Essentials (SIE) exam and the Top-Off Series 6, 7, 24, 57, 63, 65, 66, 79, 86, 87, and 99 exams. He also delivers executive one-on-one training and shares his passion for learning outside of work as a ski instructor and yoga teacher. Dave graduated magna cum laude from Fordham Law School, and cum laude with a BA from the University of Pennsylvania.

Related posts

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont

- Read more

Unlock a New Dimension of Series 7 Exam Prep with the Video Vault

Are you feeling overwhelmed by the dense text of Series 7 exam prep? Maybe you consider yourself

- Read more

Master the Series 63 Exam with the Video Vault

Are you feeling overwhelmed by the dense text of Series 63 exam prep? Do you consider yourself mo