What You Need to Pass the Series 65 and Series 66 Exams

Filed in: Pass Rates, Series 65, Series 66, Study Tips

If you plan to be an investment adviser, you will need to take the Series 65 or Series 66 Exam. In response to student feedback, Knopman Marks training for the Series 65 and Series 66 Exams now offers more coverage of insurance products, portfolio management, performance measures, and retirement plans.

Updates to the course include more video content and interactive slides focusing on the most challenging topics on the Series 65 and Series 66 Exams. The updates also reflect the latest rule changes, such as the newly enacted rule related to exempt transactions.

“We’re excited to unveil dozens of new instructor-guided videos that present practice questions mirroring the long, nuanced questions that pop up on the actual exams,” says Dave Meshkov, head of course design at Knopman Marks. “We’ve gone deeper and added a full day of course material.”

Read on for a snapshot of what’s been added to improve your chances of passing the Series 65 and Series 66 Exams on your first try.

1. Tougher Questions on Insurance

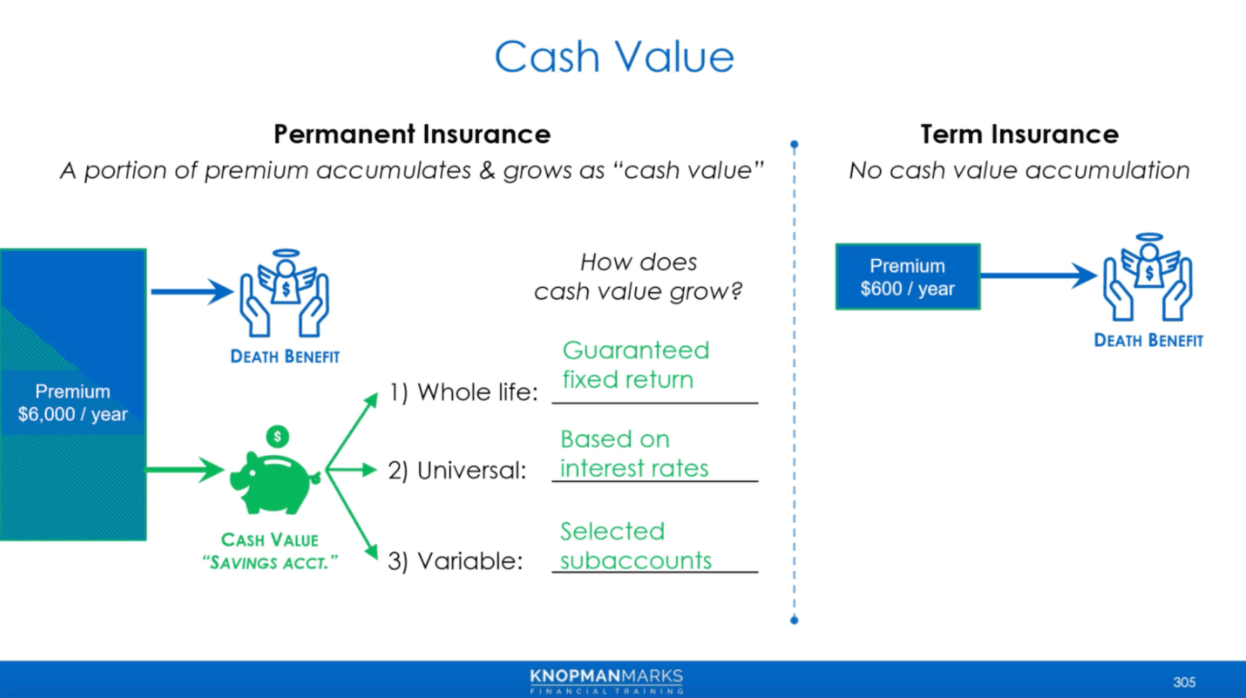

The Series 65 and Series 66 Exams require students to understand insurance-based products, including annuities and different types of life insurance. The updated course includes more coverage of both life insurance and annuities.

“We’ve added some really hard questions on insurance products that will help students test their understanding of life insurance and annuities,” Meshkov says.

Example: What type of insurance offers cash value, and how does it grow over time?

2. A Deeper Dive into Portfolio Management

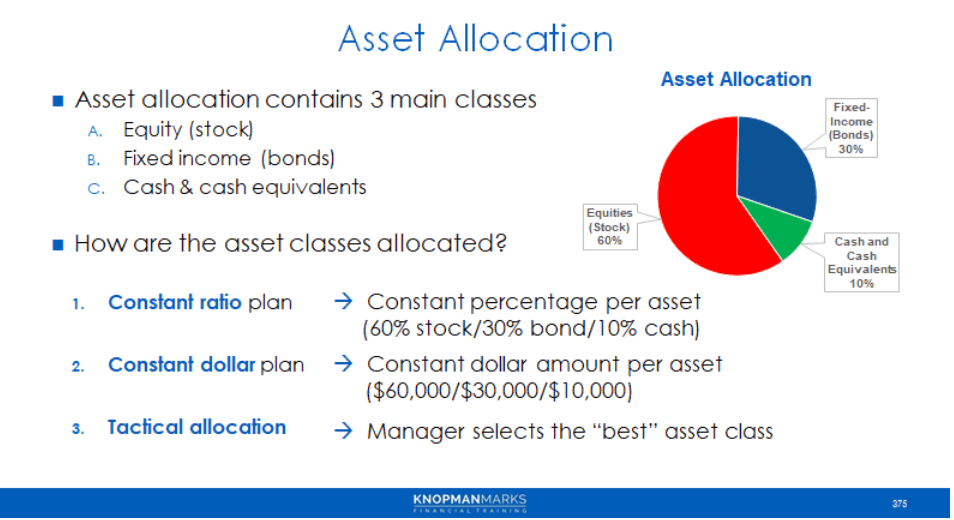

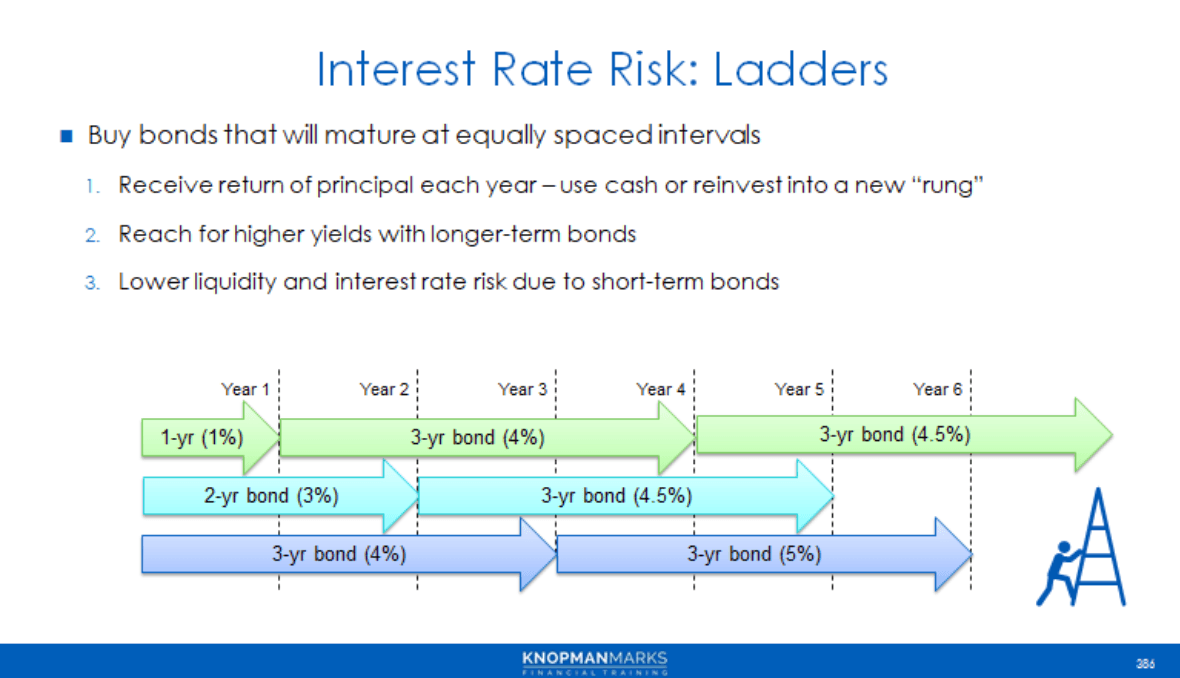

To be a financial advisor, you need to demonstrate your ability to make appropriate and suitable recommendations for clients in terms of their risk tolerance, time horizon, tax bracket, and other factors.

“The questions are challenging because they are nuanced rather than black and white,” Meshkov says. “Series 65 and Series 66 Exam takers need to exercise judgment and align their answers with what regulators say. There are often two good answers and you need to be able to discern the better answer.”

When making investment recommendations, exam candidates tend to select answers that are more aggressive than what the regulators are looking for. “Err on the conservative side,” Meshkov says. “Put on your regulator’s cap when taking these exams.”

Example: How would investors following a constant dollar plan rebalance their portfolios during a strong bull market?

More targeted suitability slides:

Example: How can fixed-income investors reduce their interest rate risk exposure?

3. Added Material on Performance Measures

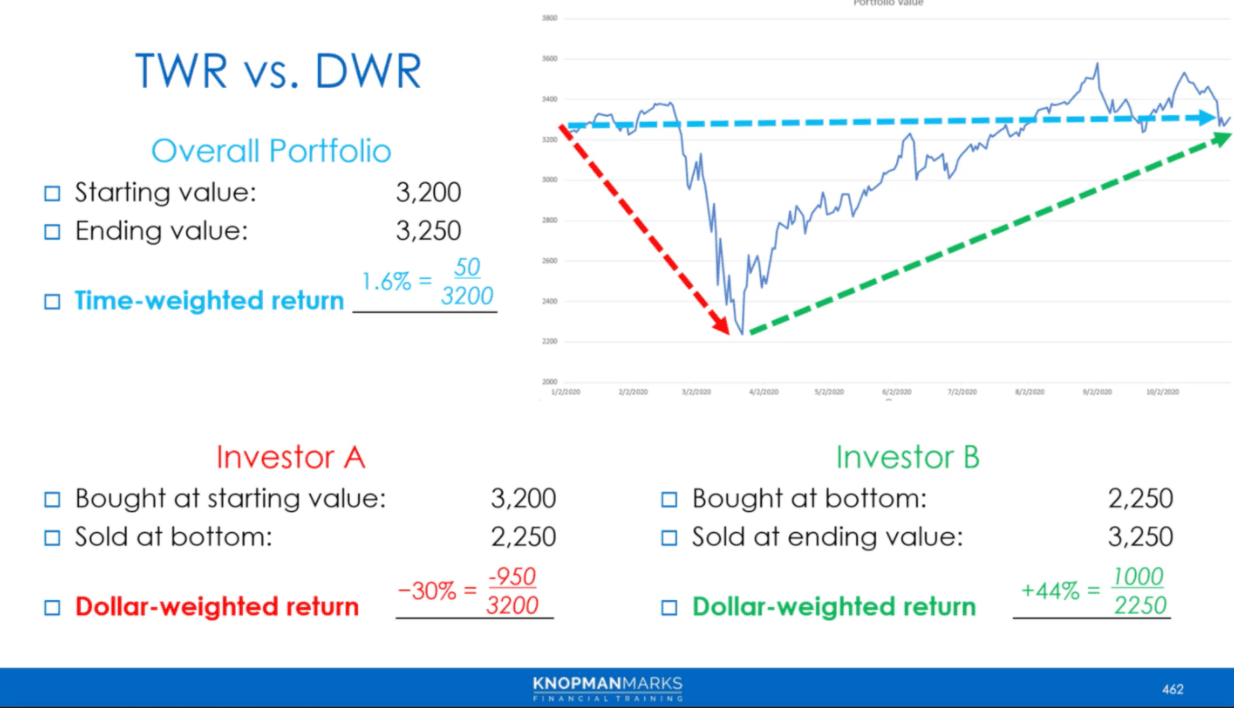

To pass the Series 65 and Series 66 Exams, you will need to understand performance measures, and how a financial advisor performs calculations like time weighted returns versus dollar-weighted returns “You need to understand the different returns, and be able to explain theory, application, and relevant calculations,” Meshkov says.

Updated class slides show what the performance measures mean, explain formulas, and guide students through questions that apply the ideas.

“In addition to running the numbers, you need to interpret what these calculations do and do not show for application questions,” Meshkov notes. Often you won’t be asked to make the calculation, but rather, you’ll be asked about the steps in the calculation, or which calculation to apply to a scenario.

Example: What’s the difference between time-weighted returns and dollar-weighted returns?

4. New Questions on Retirement Plans

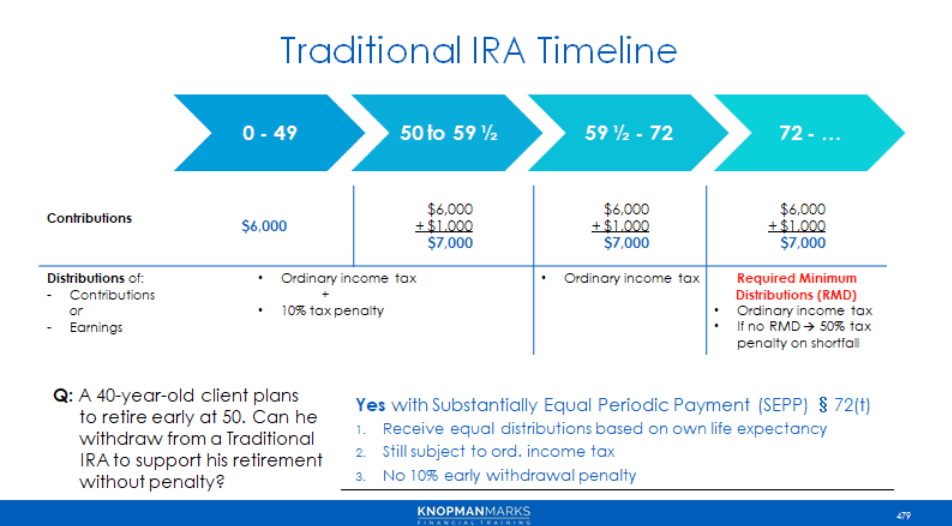

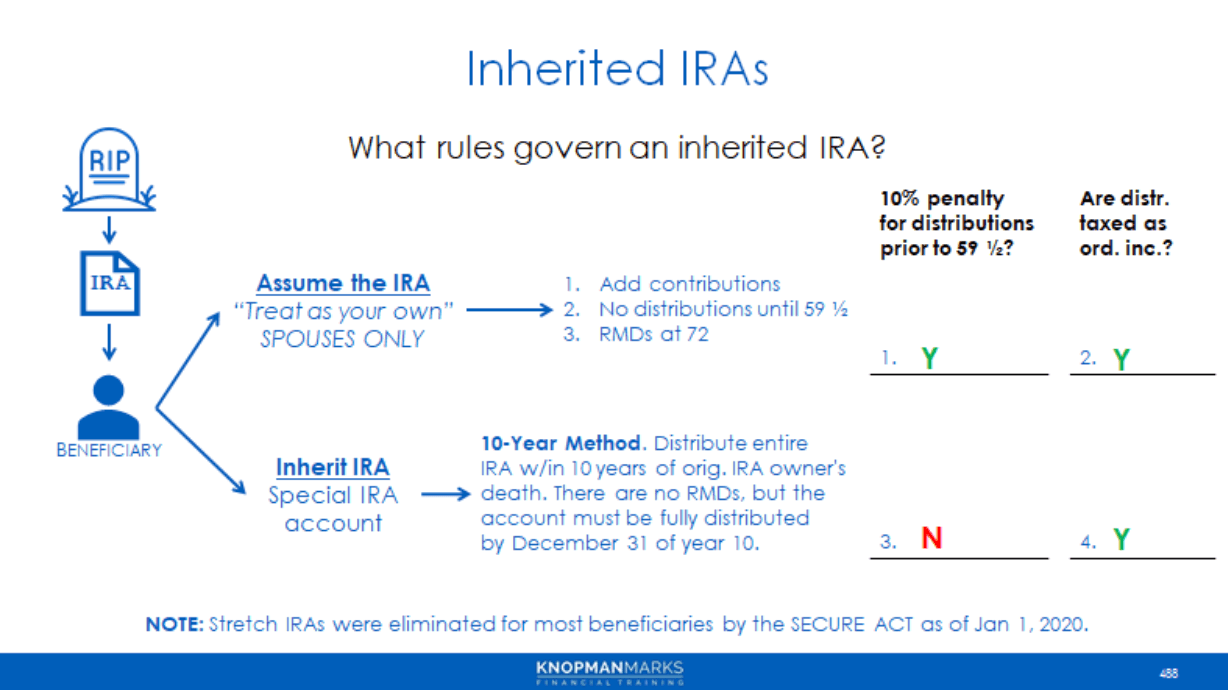

New Series 65 and Series 66 material offers a more in-depth look at the different retirement plans and their features. You will need to understand the workings of IRAs, 401(k)s, and Roth versus traditional.

Example: What are the rules governing the contributions, earnings and growth, and distributions from traditional IRAs? How might a client make an early withdrawal without facing a 10% penalty?

Example: What options are available to clients who inherit an IRA?

“The Series 65 and Series 66 are among the most difficult registered rep level exams,” Meshkov says. Both exams focus on securities products, financial planning concepts, and regulation. Both exams address the same topics, but the emphasis is different. The Series 65 includes more product, economics, and suitability questions, while the Series 66 is more heavily weighted toward state law and investment advisor regulation.

More Resources to Help You Pass

For tips on how to pass the Series 66, watch this video.

Find tips on how to pass the Series 65 Exam here.

To maximize your chances of passing, sign up now

Series 65 training or Series 66 training. |

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Exam Tips to Perform Under Pressure

High-stakes securities exams such as the SIE, Series 65, Series 79, or Series 24 can feel overwhe

- Read more

Efficient Exam Prep for Busy Professionals: Strategy Advising

Studying for a high-stakes securities exam like the Series 24 or Series 79 isn’t just about putti

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont