Rule 105 of Regulation M (Short Selling Prior to Pricing of Certain Securities Offerings)

Filed in: Exam Content, Series 24, Series 79

Rule 105 of Regulation M under the Securities Exchange Act of 1934 prohibits investors from manipulating the price of follow-on offerings by selling short prior to the pricing of the new shares. The purpose of the rule is to protect the independent pricing mechanisms of the securities markets so that offering prices result from the natural forces of supply and demand unencumbered by artificial forces.

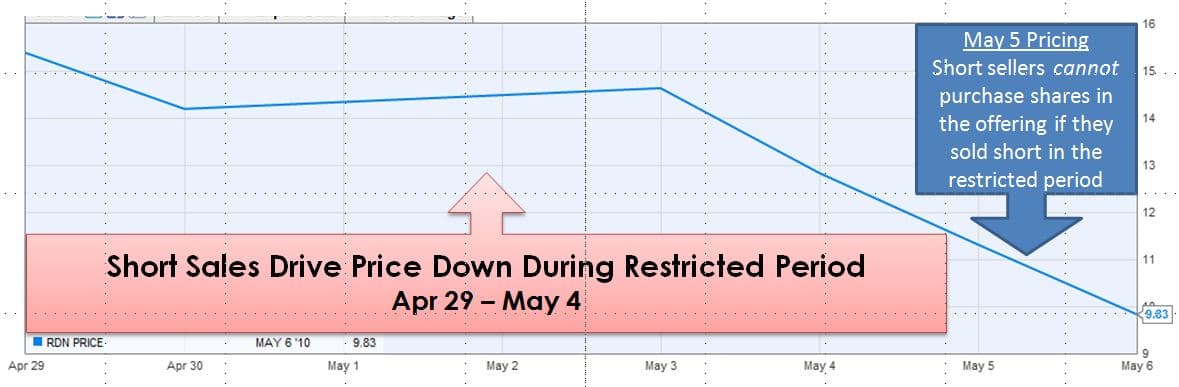

Rule 105 targets short selling that could artificially depress market prices. Investors who expect to receive offering shares may attempt to profit by aggressively short selling the security just prior to the pricing of the offering , thereby depressing the offering price, and then purchasing the lower priced securities in the offering. The rule, therefore, prohibits purchasing shares in the offering if the buyer has sold short the securities being offered during the restricted period.

The restricted period can vary, but typically begins five business days before the pricing of the offered securities and ends at the pricing.

Below is an example of stock that was shorted by an investor during the restricted period (April 29 – May 4). Because the investor engaged in the short sales, the investor is prohibited from acquiring shares in the new issue.

Regulators are charged with ensuring that securities professionals understand and abide by the securities laws. As a part of this mandate, candidates for securities licenses must demonstrate their mastery of these rules. Generalized knowledge and familiarity with the rule’s concepts and purpose is often insufficient to correctly answer the challenging multiple choice questions.Relevant Exams:

Written by Dave Meshkov

Dave's mission (and job: Managing Director of Course Design) is to make FINRA exam training engaging, approachable, and dare he even say, enjoyable. Having trained and coached over ten thousand students to exam success he knows how to present complex subjects in memorable and understandable ways. Prior to joining Knopman Marks in 2011, Dave practiced bankruptcy law at Weil, Gotshal & Manages and served as a law clerk in a the Southern District of New York Bankruptcy Court working on the General Motors and Lehman Brothers bankruptcies. Building on his legal expertise and training allows him to keep all our courses updated with the latest legislative and rule-making changes. Dave currently trains for the Securities Industry Essentials (SIE) exam and the Top-Off Series 6, 7, 24, 57, 63, 65, 66, 79, 86, 87, and 99 exams. He also delivers executive one-on-one training and shares his passion for learning outside of work as a ski instructor and yoga teacher. Dave graduated magna cum laude from Fordham Law School, and cum laude with a BA from the University of Pennsylvania.

Related posts

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont

- Read more

Master the Series 63 Exam with the Video Vault

Are you feeling overwhelmed by the dense text of Series 63 exam prep? Do you consider yourself mo

- Read more

How To Pass the Series 7 Exam in 2025

You’ve already passed your SIE and you’re ready for the next step – the Series 7 exam. The Series