Financial Planning Career: Quick Facts

| Median Salary | Depends on level of certification |

| Education/Skills Needed | Bachelor’s Degree Strong Communication Skills Analytical and Creative Problem-Solving Skills Time Management Skills |

| Recommended Securities Exams and Licenses | SIE Series 6 Series 7 Series 63 Series 65 Series 66 |

Becoming a Financial Planner

A financial planner is a specialist in the financial advisory career space. While financial advisors are generalists that provide many types of financial advice to various types of financial consumers, financial advisors focus more narrowly on the design and maintenance of a comprehensive financial plan for individuals, couples, and small businesses. They chart a course for achieving financial goals and life dreams, earning a very personal role in the lives of their customers.

Financial planners take a holistic view of a customer’s financial life and create and adapt strategy for decisions that range from spending practices to investments. In building and managing a financial plan, financial planners:

- Gather personal and financial data

- Clarify and prioritize short-term and long-term financial goals

- Create an action plan with steps to achieve financial goals that may address:

- Savings objectives

- Emergency funds

- Debt management

- Insurance and risk management, including life, disability, and property insurance

- Choosing a mortgage

- College planning

- Employee benefit management

- Retirement planning and retirement account funding

- Social Security planning

- Wills, trusts, estate planning, and charitable giving

- Counsel customer on alternatives as financial decisions are made

- Sell investment and insurance products to fund the financial plan

- Work with legal and tax professionals to establish and adapt the plan

- Monitor and adjust the plan regularly to keep it current with life changes

Where Do Financial Planners Work?

Financial planners often have offices in banks or other investment firms. They may be employed by or contracted with the investment firm to service the client base of that firm. Other financial planners are self-employed and work independently or as part of a financial planning practice group. These planners are often more highly compensated but are responsible for not only servicing, but also developing, their own client base.

New financial planners often associate with banks and investment firms to learn the business and benefit from comprehensive training programs offered by these firms.

How Are Financial Planners Paid?

Financial planners are usually compensated through one of these compensation models:

- Fee only. These advisors charge an hourly rate or a flat fee for services. Costs for a full financial plan are often in the range of $1,000 to $5,000, depending on complexity. Hourly fees often range from $300 to $500 per hour. Sometimes these advisors also charge a quarterly or annual retainer fee.

- Fee based. These advisors charge an upfront fee for services like consultation and building a plan, and then an ongoing fee for management of investments that often ranges from 0.50% to 2.00% of the assets that are being managed by the planner. Usually the fee declines as the amount of assets under management increases.

- Commission based. These advisors earn compensation based on the specific financial services or products they sell, usually through a mutual fund, insurance, or investment company.

An entry-level planner or junior planner will usually earn in the neighborhood of $40,000 to $50,000 per year, but planners that are experienced and credentialed often earn compensation of $200,000 or more per year. As in other fields, earnings are also impacted by the location of the financial planner’s practice.

The time commitment and hours vary greatly with the planner’s type of practice and client base. Financial planners must accommodate the schedules of their clients. As such, hours can be extensive and can include evening and weekend consultations, plus long hours for analysis, research, and continuing education. But as they become more established in their practice, planners frequently hire assistants or junior associates to offload some of their responsibilities and gain flexibility in their schedules.

The field has incredible potential and is recognized as the fastest growing segment of financial advisory services. Financial planning business with individuals and small businesses has reportedly doubled in five years as measured by assets under management. Nearly $300 billion of individual and small business assets are managed by fee-only planners.

How to Prepare for a Financial Planning Career

Education plays an important role in pursuing a financial planning career. A bachelor’s degree is the minimum educational requirement, with coursework in finance, accounting, or economics being helpful but not necessary. Numerous individuals enter this career from other fields instead of as new college graduates.

Personal skills that are fundamental for success include:

- Strong communication, interpersonal, and relationship managements skills. These are vital for building a client base, managing relationships, and closing business.

- Analytical and creative problem-solving skills. Building the right plan and providing appropriate advice relies on skill in understanding, projecting, and modeling client situations.

- Detail orientation and time management skills. Research alternatives and care to minimize errors are essential in this highly regulated and diverse profession.

In addition to the skill and education requirements, consider the following steps for pursuing this field:

1. Find an internship, sales assistant, or junior planner role

These roles offer one of the best ways to learn and understand the many facets of the business. A great experience may also lead to a long-term business opportunity with a chance to work with an existing client base. Finding clients can be one of the most challenging aspects of the business for new financial planners, so having an advantage is crucial for early term success.

2. Get the licenses you need

Securities and insurance licenses will be necessary for selling products to build a plan. At a minimum, you’ll need to pass the Securities Industry Essentials Exam (SIE) then the Series 6, Series 7, Series 63, Series 65, and/or Series 66, depending on your business model and state requirements as well as the breadth of securities and services you’ll offer. Insurance licenses may also be necessary to address the full spectrum of financial needs in the financial plan.

Anyone 18 or older is permitted to take the SIE Exam, which tests foundational knowledge of the securities industry and its regulations. This credential is a great resume builder and can help you jump ahead as a candidate for a desirable financial planning position. You will then need to pass additional exams, but most can only be taken after you are associated with a firm or practice.

3. Commit to professional development and certification

This profession’s high level of regulation and constant change requires significant continuing education. Credentials like the Certified Financial Planner (CFP) and Chartered Financial Consultant (ChFC) are well recognized and help distinguish professionals in the field. These designations can only be pursued after a practitioner has at least three years’ worth of experience in the financial planning field with a respectable firm. Well-known and rigorous credential programs not only enhance credibility but also earning potential; in fact, Certified Financial Planners often earn double what their non-designated counterparts make.

Gain an Edge in Pursuing a Financial Planning Career

If you’re interested in a financial planning career, the SIE Exam should be on your list of priorities. Preparing for this exam will help you learn the foundation and language of the industry and will demonstrate your initiative to potential employers. Turn to Knopman Marks for the industry’s best guidance on how to pass the test the first time. We will share our best practices for success and give you valuable assistance every step of the way.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

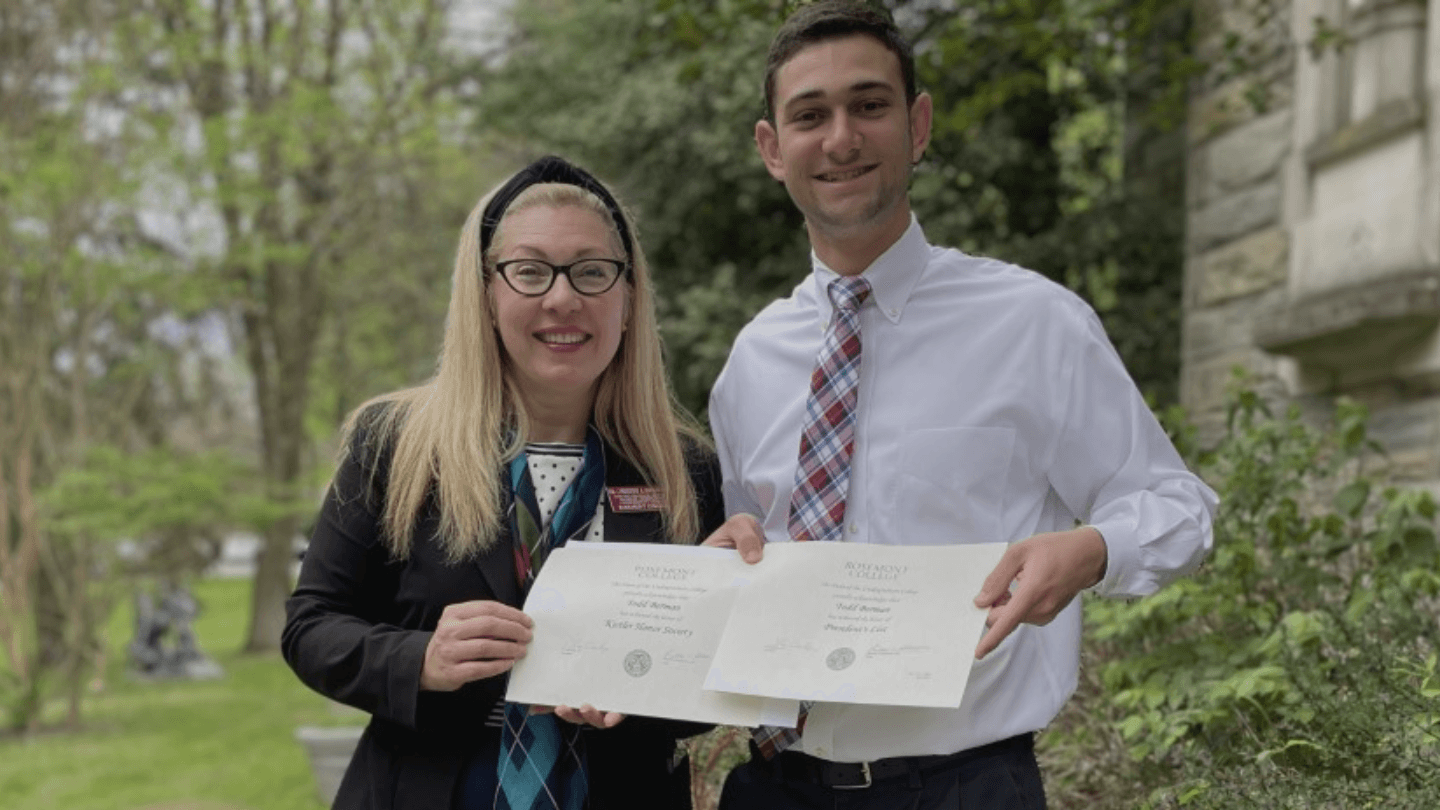

SIE Scholarship Helps College Students Pursue Dream Careers in Finance

After Rosemont College senior Brandon Lam finished taking his SIE exam, he ran outside to the big

- Read more

Introducing How to Finance: A Beginner’s Guide to the Industry

One of our primary roles as educators is to bridge gaps in knowledge. Our newest course, How to F