Financial Analyst Career: Quick Facts

| Median Salary | $85,660 |

| Education/Skills Needed | Bachelor’s Degree in Business or Finance Analytical and Mathematical Skills Spreadsheet and Computer Skills Presentation Skills |

| Recommended Securities Exams and Licenses | SIE Series 7 Series 63 Series 79, 86, 87 |

Becoming a Financial Analyst

Also known as “investment analysts” or “securities analysts,” financial analysts provide guidance to businesses and individual investors when choosing investments and building portfolios. They research businesses and industries, monitor their performance, and project future results from their models and analysis. This career choice is often a path to high-level and lucrative positions in prominent financial firms, so expect significant competition for entry level positions in this field.

A financial analyst’s day-to-day responsibilities include:

- Analysis and interpretation of company financial statements and industry data

- Study of macro and micro economic trends

- Preparation of valuations and performance projections of businesses and industries

- Meeting with company representatives for insight into business operations and assessment of management capabilities

- Compiling written reports and presentations for investment decisions

Most financial analysts focus on a specific industry, product type, or geographical region. For example, analysts that concentrate on the airline industry research and develop expertise in the business’s problems, competition, and trends that impact profitability of airlines. They evaluate new regulations, business environments, and political conditions in countries or regions that they cover. Because of the globalization of many businesses, candidates with various language skills and cultural backgrounds are combined to create stronger teams with broader expertise.

Where Do Financial Analysts Work?

Financial analysts work on both the buy-side and sell-side of the financial industry.

- Buy-side analysts are employed by institutions that purchase investments for their portfolios. Likely employers are mutual funds, hedge funds, insurance companies, pension funds, independent money managers, and non-profits with endowments to manage.

- Sell-side analysts are employed by broker-dealers and other companies that distribute financial products, like stocks and bonds, to retail and institutional investors.

Other employment opportunities exist in independent firms like business media firms and research firms, which are neither buy-side nor sell-side.

Financial analysts support important functions in financial firms, including:

- Fund and portfolio management – Provide the information necessary for managers to make buy and sell decisions for the portfolio

- Risk management – Help identify and mitigate potential risks and losses to aid in selecting an appropriate investment mix

- Ratings analysis – Use financial analysis and projecting to determine the financial strength of companies and governments that issue bonds and their ability to repay their obligations

Financial analysts usually work full-time and often commit more than 40 hours per week. After-hours work is necessary to complete research because office hours are filled with meetings with other businesspeople. They usually work on teams to complete projects, so interpersonal skills are important. Travel can be frequent, but most entry-level analysts will be based in an office. Many financial analysts are based in large New York City firms and other metropolitan financial centers.

How to Prepare for a Career as a Financial Analyst

1. Earn a bachelor’s degree

A degree in finance, economics, mathematics, accounting, or business is the traditional background, and you’ll need strong skills in statistics, computer modeling, and spreadsheets. However, if you don’t have a financial background, the door may still be open. Backgrounds in health, music, agriculture, and other sectors are now recognized as useful in analysis of specific industries, and major firms are hiring candidates with these areas of expertise and no financial background for better perspective. Excellent communication skills, for reporting findings in a persuasive and clear manner, are also critical.

2. Find an internship

Start working on finding a financial internship in the second year of your undergraduate program. The big investment banks recruit almost exclusively at elite colleges and universities, but your network may help in finding a position. If your degree is from a less-recognized school, you may need to consider getting an MBA from a stronger business school to break into the field.

3. Get securities licensed

The firm that hires you will require you to get securities licensed. Generally, you’ll need a Series 7, a Series 63, and possibly a Series 79, 86, or 87 license, which you can only acquire after you are employed and sponsored by a financial firm. However, you can improve your resume by passing the Securities Industry Essentials Exam (SIE) before you are hired.

4. Commit to professional development and certification

You’ll need to take required continuing education courses and keep your licenses up to date. Employers often recommend certifications for career advancement. In this field, the Chartered Financial Analyst (CFA) certification from the CFA Institute is highly recommended. Financial analysts can become CFA certified if they have a bachelor’s degree, acquire four years of qualified work experience, and pass the three levels of exams. Other certifications in specialized fields are also available.

How Are Financial Analysts Paid?

Financial analysts are paid salary and may also receive a bonus of 25% or more of their salary. The median annual wage for financial analysts was $85,660 in May 2018. The lowest 10% earned less than $52,540, and the highest 10% earned more than $167,420. Financial analysts at large Wall Street firms are often paid substantially more, with first-year total compensation packages of $140,000 or greater at investment banks.

In 2018, financial analysts held approximately 329,500 jobs, and the outlook for the field is strong. According to the Bureau of Labor Statistics, the job growth rate for financial analysts is expected to increase 12% through 2024, substantially above the average for all occupations.

Get Ahead of the Game

If you are serious about pursuing a career as a financial analyst, initiative and a strong resume are essential. You can take steps now to improve your chances for hire by adding the SIE Exam to your list of priorities. Preparing for this exam will help you learn the foundation and language of the industry. Turn to Knopman Marks for the industry’s best guidance on how to pass the test the first time. We’ll share our best practice tips for success every step of the way.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

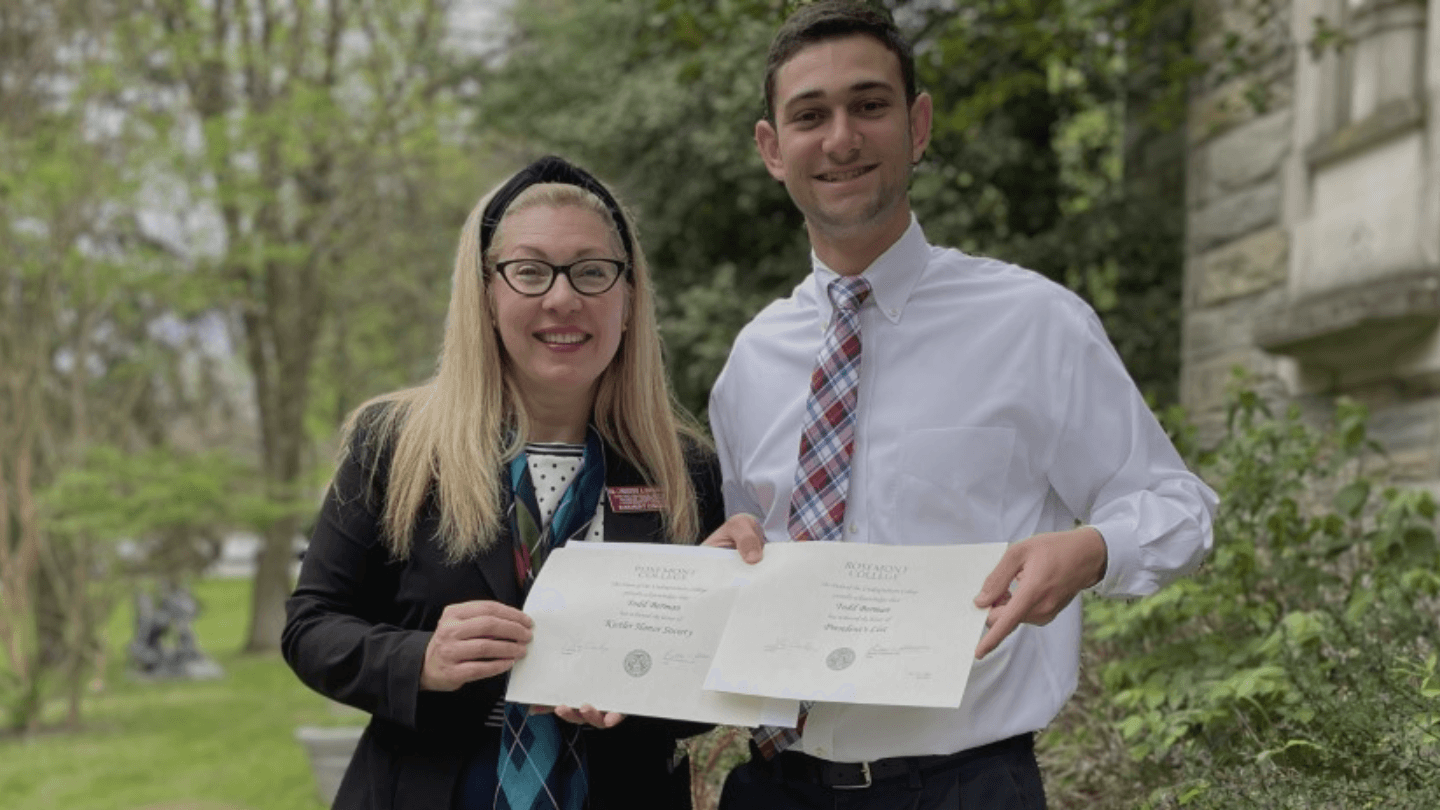

SIE Scholarship Helps College Students Pursue Dream Careers in Finance

After Rosemont College senior Brandon Lam finished taking his SIE exam, he ran outside to the big

- Read more

Introducing How to Finance: A Beginner’s Guide to the Industry

One of our primary roles as educators is to bridge gaps in knowledge. Our newest course, How to F