FINRA provided significant updates on the upcoming Securities Industry Essentials Exam (SIE) and corresponding “top-off” exams at the recent Association of Registration Management (ARM) conference held March 6 – 8, 2018. With the October 1 implementation of these new exams rapidly approaching, registration process reviews and internal education initiatives are in high gear.

For additional SIE background information, check out our SIE exam page and our recent SIE related articles.

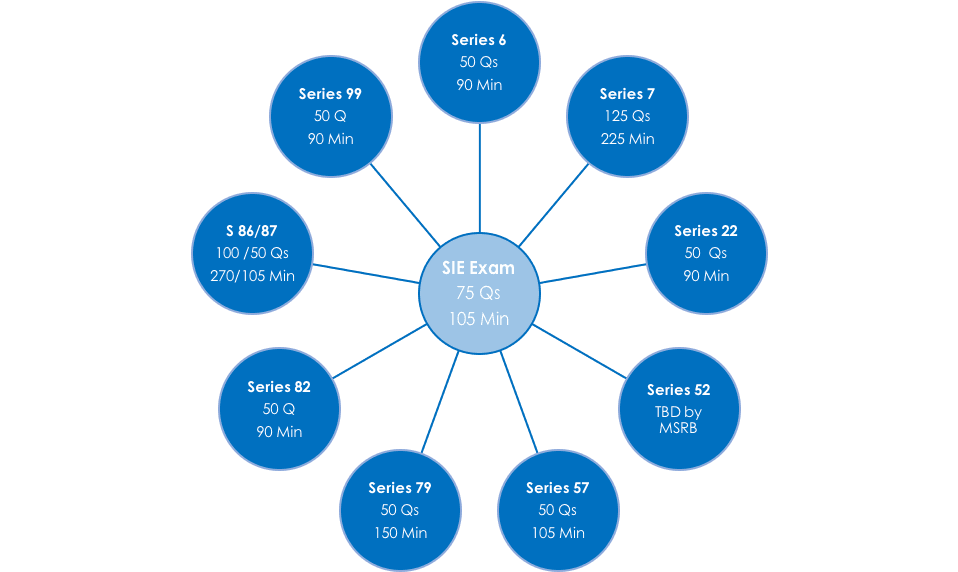

Top-Off Summary

The chart below summarizes the exam length and time allotted for the exams that will require the SIE as a co-requisite for registration. Note that the MSRB has stated their intention of requiring the SIE as a co-requisite for the Series 52 beginning on October 1, 2018, but that details of the top-off exam are not yet available.

SIE Exam FAQs

The FAQs below are intended to summarize some of the newest information related to these exam, and are categorized as follows:

- Transition Period

- Exam Difficulty and Content Coverage

- Study Materials for New Exams

- SIE Candidate Enrollment

- Exam Administration

- Cost and Payment for SIE Exams

- Special Exam Accommodations

- Leaving the Industry after SIE Implementation

1. Transition Period

- Should persons that need to get registered this year wait to take the SIE exam?

We encourage candidates to take the current exams by September 30, 2018, if possible. Whenever new exams are released there is some uncertainty about the scope of coverage. Also, Series 6, 79 and 99 candidates should expect topics on the SIE that are not on the current exams (e.g. options, municipal bonds). These candidates will find the current form of the exams more relevant to their job functions, and likely slightly easier. Furthermore, if candidates want to allow for more than one chance to take the current exam, they should test no later than August 30th (discussed further in the next question).

- If a candidate takes and fails the current exam in September 2018, can the candidate still re-take that exam?

No. If a candidate fails a current form of the exam and the first re-take eligibility date is on or after October 1, the candidate will be required to take the SIE plus the appropriate top-off exam. For example, a candidate who fails the Series 7 for the first time on Sept 10th would not be able to re-take the Series 7 until Oct 10th. Therefore, the candidate will be required to take the SIE and Series 7 top-off exams instead of the current Series 7. Note that there is no 30-day wait between the current exams and SIE or top-off since they are different tests. Effectively, candidates get a “clean slate.”

- When will the current exams be retired?

The exams that will be replaced by the SIE and corresponding top-off will no longer be offered after January 31, 2019. The old exams are available through January 2019 because persons that register for an existing exam on September 30, 2018, have a 120-day window to take their exam.

- What is the registration status after October 1, 2018, for individuals who hold registrations that will be retired (i.e. 11, 17, 37/38, 42, 62, 72)?

Persons with these registrations will be grandfathered in their registration category while they remain associated with a member firm. If in the future they must acquire additional registrations, they will not have to take the SIE. For example, if persons who hold the Series 72 prior to October 1, 2018, must become Series 7 registered in 2019, they will take the Series 7 top-off only.

The consequences of leaving the industry and seeking re-registration after 2 years are discussed in a subsequent question.

2. Exam Difficulty and Content Coverage

- How does the SIE exam compare to current Series exams?

The SIE exam is designed to test candidates on industry fundamentals and minimize the redundancy of content between exams. It is not a simplification of prior exams. For example, a question on Outside Business Activities (OBAs), a topic that will be included on the SIE since it applies to all registration categories, will be tested at the difficulty level currently tested on Series 7. A topic that doesn’t apply to all registrations will be tested at a foundational level on the SIE if at all, but then in detail and degree of difficulty similar to current exams on the relevant top-off(s).

It might be helpful to think of the new SIE as an “abbreviated Series 7” because of its breadth of coverage of industry topics.

- Will the top-off exams cover fewer rules and concepts than in the past since there are fewer questions?

No. Some of the top-off content outlines are actually longer and broader than the current registration category content outlines. The difference in length is that the foundational concepts will no longer be included.

- Will some registrations require broader knowledge of industry topics and rules than required by current exams?

Yes. Series 6, 79 and 99 candidates should expect topics on the SIE that are not covered by the current exams (e.g. options and municipal bonds).

With this in mind, future candidates for these exams may find SIE and the corresponding top-off a greater challenge to prepare for than the current, more narrowly focused exams.

3. Study Materials for New Exams

- When will SIE study materials be available from Knopman Marks?

Knopman Marks will release its SIE study materials during the summer of 2018. A full line of top-off materials will be released throughout the summer for availability by the October 1 implementation date.

4. SIE Candidate Enrollment

- How do candidates that are not sponsored by member firms register for the SIE?

FINRA is developing a new SIE enrollment system that will be available to non-sponsored candidates, like college students and career changers. The system will be accessible through FINRA’s website. SIE candidates will be required to create an account to pay their exam fee, and may schedule exams directly with Prometric through the enrollment system.

Firms may also register non-associated candidates through the enrollment system, either on an individual or group basis. They can use vouchers available through FINRA to pay exam fees. (See subsequent questions about vouchers).

All top-off exam candidates must be sponsored by member firms, and U-4 forms will be required to open an exam window.

- Can firms view SIE attempts and results of non-associated persons?

Firms may view SIE attempts and results only for persons they sponsor or pay for through the voucher process (discussed further in a subsequent question). This information will be available through the FINRA enrollment system.

5. Exam Administration

- When can a candidate first register for the SIE?

Registration for the SIE can begin October 1, 2018. To take the SIE exam, candidates must be “enrolled” in FINRA’s new SIE enrollment system that is currently under construction, and will be accessible on FINRA’s website. Persons like college students and career changers that are not associated with a firm, may enroll themselves into the system; persons that are associated with firms may be enrolled by their firms through CRD similar to current process.

- How is the exam scheduled?

Both the SIE and top-off exams will be administered by Prometric. Exam appointments can be made with Prometric directly from FINRA’s website. Once candidates are enrolled for an exam they will have a 120-day window to schedule an appointment with Prometric, as they do currently.

Although it is recommended that exam dates are scheduled as far in advance as possible, it is anticipated that scheduling an SIE or top-off exam may be easier than in the past at many exam centers due to the shorter length of the new exams.

- What qualifications are needed to take the SIE?

Candidates must be at least 18 years of age to take the SIE exam. There is no educational or experience requirement. Sponsorship by a member firm is no longer necessary, so it is expected that college students and career changers will take this exam as both a resume builder and/or to pre-screen their level of interest in the financial services industry.

- Can candidates take both the SIE and top-off on the same day?

Yes, this is possible for candidates that are associated with member firms (member firms must sponsor candidates for top-off exams). However, it is anticipated that most candidates will first complete the SIE, and then begin a separate study process for the appropriate top-off. We believe candidates will experience best results following this two-step method.

- Will SIE and top-off candidates receive their exam scores?

Persons who pass SIE exams or top-offs will not receive a score. A “pass” result will be reflected in their record. Persons who fail, however, will receive a score and breakdown by subject matter. This will assist in determining the study effort necessary for success on the subsequent attempt.

This same convention will apply to all other exams administered by FINRA after October 1, 2018, even those not affected by SIE (Series 63, 66, etc.).

- If a firm hires an individual who has passed the SIE, can it review that individual’s score and/or number of attempts to pass the exam?

No. Once a person has passed the SIE, exam history is no longer available. FINRA has determined that the number of attempts to pass an exam or an exam score is not relevant to future job performance or background checks.

6. Cost and Payment for SIE Exams

- What is the SIE exam fee? What are the exam fees for top-offs?

The SIE exam fee is $60. Under the new SIE/top-off exam process, the cost of both exams will be equivalent to the current single exam cost. For example, the current Series 7 exams costs $305. Upon SIE implementation, the SIE will cost $60, and the Series 7 top-off will cost $245.

- Can firms pay for the SIE exam fees of candidates who are not associated?

Yes. FINRA announced a “voucher” process that will allow member firms to pay SIE exam fees for non-associated persons. Firms can buy SIE vouchers from FINRA for $60 each, and assign them to exam candidates. Candidates will then use the voucher number as their payment method when registering to take the SIE exam.

- How can firms purchase vouchers?

SIE exam vouchers may be purchased by member firms through the FINRA enrollment system for $60 each. The vouchers expire 6 months from date of issue.

- What if a voucher is not used within the 6-month period?

Vouchers will expire with no redemption value after 6 months from their issue date. Firms will not receive refunds for unused vouchers.

- Can a voucher be transferred to another person if the original recipient does not take the SIE?

Yes, but the 6-month expiration period does not change. Assume a voucher is issued on January 1st with expiration on June 30th. If the original recipient decided on March 1st not to take the SIE, the firm could transfer it to another SIE candidate. However, that second candidate must test prior to the original expiration date of June 30th or the voucher will expire.

There is no limit on the number of times the voucher may be transferred within the 6-month period.\

7. Special Exam Accommodations

- Can candidates request special accommodations for completion of the SIE?

Yes, candidates can still request special accommodations for medical or other reasons.

- Can candidates with English as a second language request extra time?

No. FINRA will no longer permit extra time for Limited English Proficiency (LEP). After studying past requests for additional time, FINRA found that such requests were infrequent, and that candidates used little of the additional time.

8. Leaving the Industry After SIE Implementation

- What if currently registered persons leave a member firm for more than two years?

Current registrants who leave the industry and return between 2 and 4 years after leaving, will not need to take the Essentials Exam, only the appropriate top-off exam. Persons who return more than 4 years later will need to take both the SIE and the top-off exam.

- What if people who hold retired registrations (i.e. 11, 17, 37/38, 42, 62, 72) leave the industry for more than 2 years?

Persons who held retired registrations that are not associated with member firm for a period of more than 2 years, will be required to pass a top-off exam to become registered. If they leave the industry for more than four years they will also be required to re-take the SIE.

Keeping Current on SIE

In addition to staying connected with the Knopman Marks team for further SIE/top-off updates, check out FINRA’s Exam Restructuring page (http://www.finra.org/industry/exam-restructuring) for detailed information about this new process.

Subscribe to our SIE Newsletter below for regular for updates on the SIE exam and top-offs. We are committed to delivering the best exam prep materials for these new exams, and are happy to help with any questions you may have about this revised exam process.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

Crush the SIE Exam with the Video Vault

Are you feeling overwhelmed by the sheer volume of Securities Industry Essentials (SIE) exam cont

- Read more

Why Should I Take the SIE Exam in College?

In the era of asynchronous learning college students are turning to various self-study methods an

- Read more

How to Pass the Series 66 in 2024

Are you stressed about taking your Series 66 Exam? This is a tough exam, and many candidates who