U.S. companies are required to register with the SEC and file ongoing financial disclosures if they register securities for public sale or have at least $10mm in assets and 2,000 shareholders. SEC filers are required to periodically submit information to the SEC, which is subsequently made available to investors via the SEC’s EDGAR website

(http://www.sec.gov/edgar.shtml).

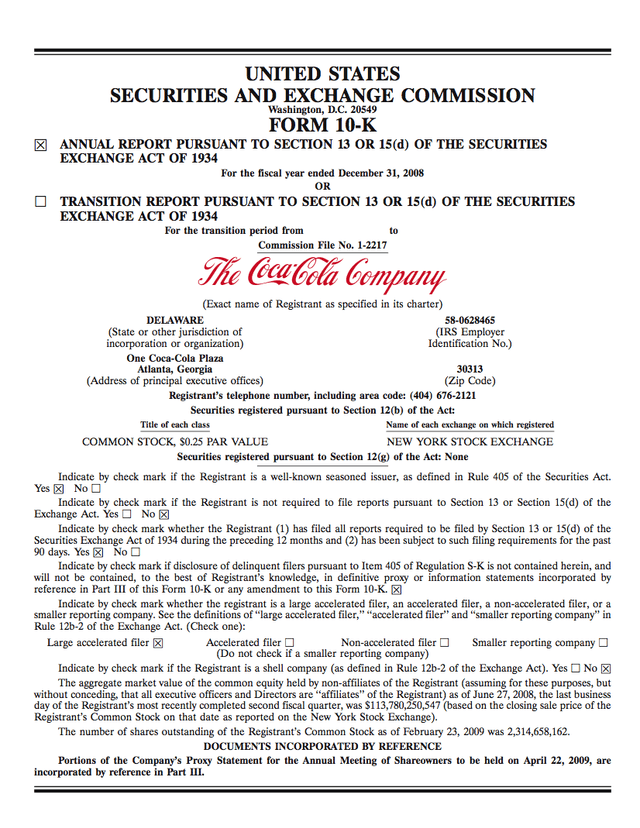

One important document filed by companies, pursuant to this rule, is a 10-K, or annual audited report, filed after the company’s fiscal year end. Companies have different filing deadlines depending on the firm’s size.

• Large accelerated filers (firms with $700 million or more in public float) must file their 10-Ks with 60 calendar days from fiscal year end,

• Accelerated filers (firms with $75 million or more and less than $700 million in public float) must file 10-Ks within 75 calendar days of fiscal year end, and

• Non-accelerated firms (less than $75 million in public float) have 90 calendar days to file

A 10-K, which may approach 200 pages for large companies, is an annual report of the company’s financial condition. It includes a detailed description of the company’s performance over the previous year, both in narrative form and in financial form. For example, it will disclose the company’s income statement from the previous year and will also describe market events that positively or negative effected profits.

In addition to full financial disclosure of the company’s financial and operating performance, it will list:

• Shareholders who own more than 5% of the company,

• Senior management, including their annual compensation, and

• Members of the Board of Directors (a majority of who must sign the 10-K)

Knopman Notes

The 10-K is a comprehensive regulatory filing that investors and their advisers should review to gain insight about companies and inform their investment decisions. Of course, these documents form only a part of any reasoned judgment about the merits of an investment. One note to keep in mind is that current law requires the report be signed by:

1. The registrant (the company itself),

2. Principal executive officer (CEO),

3. Principal financial officer (CFO),

4. Controller or principal accounting officer (CAO), and

5. By a majority of the board of directors or persons performing similar functions

Relevant Exams

Series 7, Series 24, Series 65, Series 66, Series 79

Written by Dave Meshkov

Dave's mission (and job: Managing Director of Course Design) is to make FINRA exam training engaging, approachable, and dare he even say, enjoyable. Having trained and coached over ten thousand students to exam success he knows how to present complex subjects in memorable and understandable ways. Prior to joining Knopman Marks in 2011, Dave practiced bankruptcy law at Weil, Gotshal & Manages and served as a law clerk in a the Southern District of New York Bankruptcy Court working on the General Motors and Lehman Brothers bankruptcies. Building on his legal expertise and training allows him to keep all our courses updated with the latest legislative and rule-making changes. Dave currently trains for the Securities Industry Essentials (SIE) exam and the Top-Off Series 6, 7, 24, 57, 63, 65, 66, 79, 86, 87, and 99 exams. He also delivers executive one-on-one training and shares his passion for learning outside of work as a ski instructor and yoga teacher. Dave graduated magna cum laude from Fordham Law School, and cum laude with a BA from the University of Pennsylvania.

Related posts

- Read more

How To Pass the Series 7 Exam in 2025

You’ve already passed your SIE and you’re ready for the next step – the Series 7 exam. The Series

- Read more

How to Pass the Series 24 Exam in 2024

Balancing the demands of your career, personal life, and the Series 24 Exam can be challenging At

- Read more

How to Pass the Series 66 in 2024

Are you stressed about taking your Series 66 Exam? This is a tough exam, and many candidates who