Significant money market fund reforms adopted after the 2008 financial crisis have reached their implementation date. With the intention of helping reduce the risk of runs on money market funds in highly volatile markets, these amendments to Rule 2a-7 of the Investment Company Act of 1940 are effective October 14, 2016.

The final rules were adopted in 2014 and allowed a two-year transition period to provide both funds and investors time to adjust their systems, operations and investing practices.

Three Major Changes

The three reforms that are now effective include:

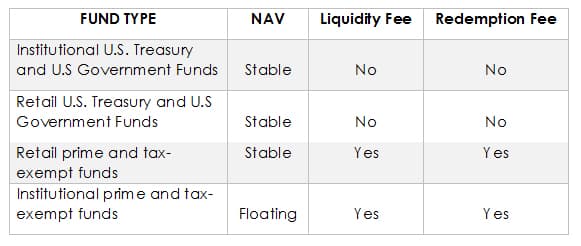

1) Floating net asset value (NAV) for institutional prime and tax-exempt funds. These funds which are primarily held by institutional investors rather than individuals must price and transact at a “floating” NAV per share that fluctuates based on the price of the underlying securities. The NAV will be priced to four decimal places ($1.0000). Government funds and retail funds may continue to transact at a constant $1.00 net asset value (CNAV).

Prime funds are money market funds that primarily invest in corporate debt securities.

2) Liquidity fees. If during a period of extraordinary financial stress, a fund’s weekly liquid assets fall below 30% of total assets, the fund’s board may impose a fee of up to 2% on redemptions. If a fund’s weekly liquid assets fall below 10%, the fund’s board is required to impose a 1% redemption fee unless the board determines doing so would not be in the best interest of the fund shareholders.

3) Redemption gates. If during a period of extraordinary financial stress, a fund’s weekly liquid assets fall below 30%, the board may suspend redemptions up to 10 days.

The table below summarizes the application of these reforms:

Previously adopted disclosure rules require money market funds to display on their websites market-based NAVs and daily and weekly liquid assets, as well as information related to shareholder inflows and outflows, imposition of fees or gates, and any use of affiliate or sponsor support on a daily basis.While government money market funds are not required to impose the new fees and gates provisions, these funds can voluntarily implement them if previously disclosed to investors.

In addition, instead of the money market funds publicly reporting their holdings every month with a 60-day delay, they must publicly report their holdings every month within five business days.

Knopman Marks Keeps You Informed

Series 6, 7, 9,10, 24, 26, 65 and 66 exams may include questions on these reforms. For more information, https://www.sec.gov/News/PressRelease/Detail/PressRelease/1370542347679.

Check back for regular updates from Knopman Marks to keep you up-to-date with the latest rule changes.

Written by Marcia Larson

Marcia Larson is Vice President, Faculty, at Knopman Marks Financial Training, New York, NY. She has extensive experience in financial licensing and regulatory training, having authored, developed and presented courseware for numerous securities and insurance exam preparation and continuing education and compliance programs. Before joining Knopman Marks, Marcia was Director of Annuity Products and Business Development at CUNA Mutual Group, where she developed and marketed industry-leading annuity products and retirement solutions and implemented distribution relationships. She was previously VP, Securities Products for Kaplan Financial, managing securities training products and subsequently, international training and businesses development. Marcia has trained thousands of financial industry exam candidates throughout their careers, and also college students as an adjunct professor. Marcia was a summa cum laude graduate of Wartburg College with degrees in Business Administration and Piano Performance. Marcia also holds the designations of Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter (CLU®), Certified Employee Benefit Specialist (CEBS), and Fellow Life Management Institute™ (FLMI®). She currently teaches the SIE, Series 6, 7, 24, 50, 52, 63, 65, and 66 exams.

Related posts

- Read more

How to Pass the Series 66 in 2024

Are you stressed about taking your Series 66 Exam? This is a tough exam, and many candidates who

- Read more

SEC Shortens Settlement Cycle for Most Securities to T+1: Updates for Exams Going Forward

The SEC has officially updated the rules to shorten the standard settlement cycle for most securi

- Read more

2024 FINRA Annual Conference Recap

Our team traveled to the FINRA Annual Conference in Washington, DC last week and wanted to share